ST-6 6210042 Rev. 07/22

Mailing address: Virginia Department Of Taxation, Direct Payment Permit Sales And Use Tax, P.O. Box 26627, Richmond, VA 23261-6627

Form ST-6 Virginia Direct Payment Permit

Sales and Use Tax Return

For Periods Beginning On and After January 1, 2023

*VAST06125888*

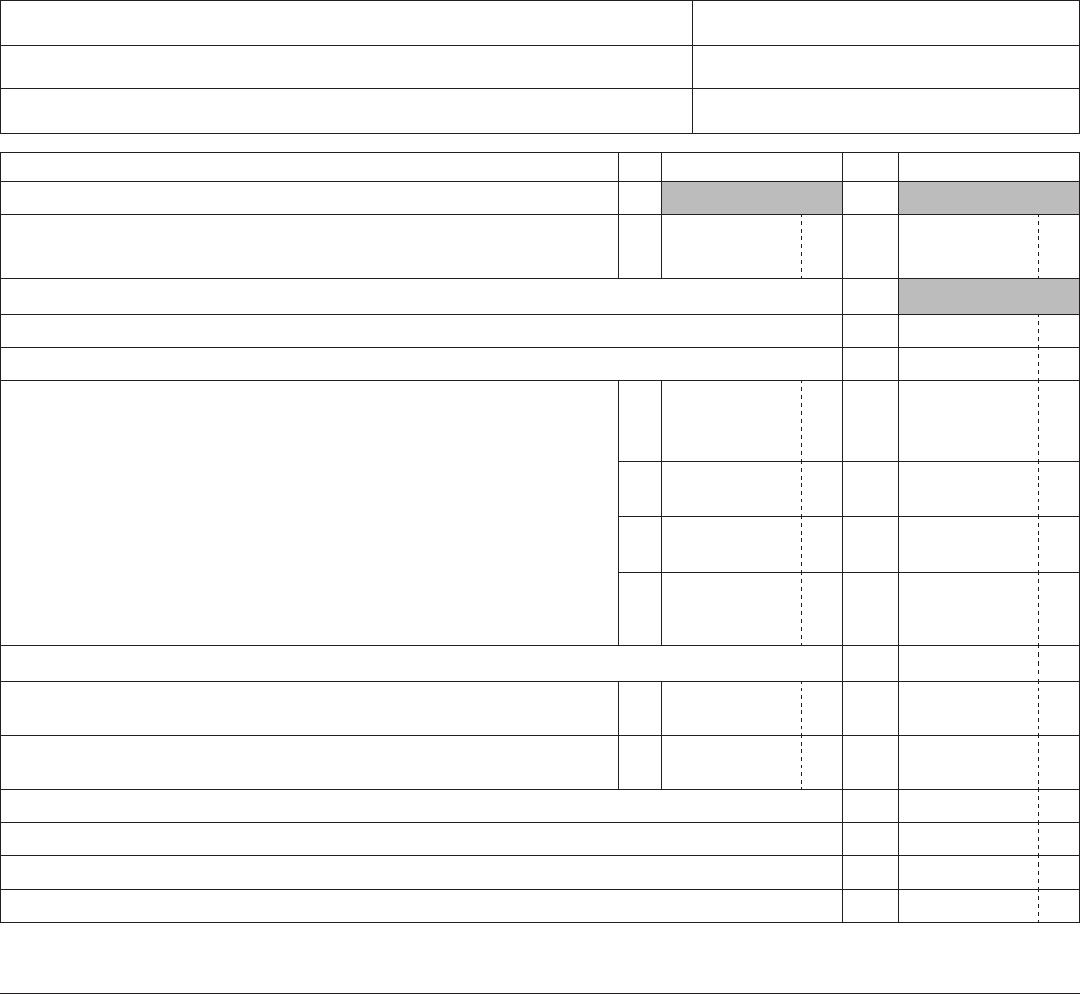

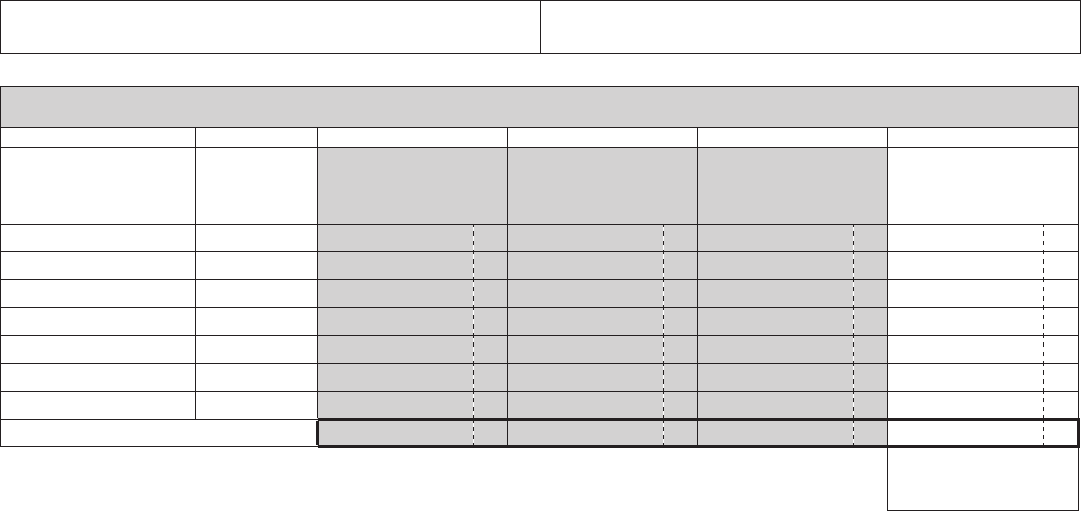

DIRECT PAYMENT PERMIT SALES AND USE TAX A-COST PRICE B-AMOUNT DUE

1 RESERVED

1

2 Tangible Personal Property Subject to State General Sales and Use Tax Rate. Enter cost

of tangible personal property in Column A (See ST-6A Worksheet). Multiply Column A by

the rate of 4.3% (.043) and enter the result in Column B. 2 x .043 =

3 RESERVED

3

4 Dealer Discount. See ST-6A Worksheet.

4

5 Net State Sales and Use Tax. Line 2, Column B minus Line 4.

5

6 Additional Regional State Sales Tax. See ST-6A Worksheet.

6a Northern Virginia. Enter the portion of Line 2, Column A attributable to Northern

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. 6a x .007 =

6b Hampton Roads. Enter the portion of Line 2, Column A attributable to Hampton

Roads in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. 6b x .007 =

6c

Central Virginia. Enter the portion of Line 2, Column A attributable to Central

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter result in Column B.

6c x .007 =

6d

Historic Triangle. Enter the portion of Line 2, Column A attributable to the Historic

Triangle in Column A on this line. All taxable sales reported here in Column A should

also be included in the taxable sales reported in Column A of Line 6b. Multiply

Column A by the rate of 1.0% (.01) and enter the result in Column B.

6d x .01 =

7

Total State and Regional Tax. Add Line 5; Line 6a, Column B; Line 6b, Column B;

Line 6c, Column B; and Line 6d, Column B 7

8 Local Sales and Use Tax. Enter cost of tangible personal property subject to Local Sales

and Use Tax in Column A. Multiply Column A by the rate of 1.0% (.01) and enter the result

in Column B. See ST-6A Worksheet and complete Form ST-6B. 8 x .01 =

8a Additional Local Option Tax. Enter cost of tangible property subject to Additional Local

Option Sales and Use Tax from Column F of Form ST-6S in Column A. Multiply Column A

by 1.0% (.01) and enter the result in Column B. 8a x .01 =

9 Total State, Regional, Local, and Additional Local Tax. Add Lines 7, 8, and 8a in Column B.

9

10 Penalty. See ST-6A Worksheet.

10

11 Interest. See ST-6A Worksheet.

11

12 Total Amount Due. Add Lines 9, 10, and 11. Also enter this amount on Form ST-6V.

12

Declaration and Signature.

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Signature Date Phone Number

General. A Direct Payment Permit is issued on the condition that the holder will le returns with the Department and allocate the local tax so that no county or city will

lose any revenue because of the issuance of the permit. Form ST-6 is used to report and pay the tax. Form ST-6 should not be led unless previously authorized by the

Tax Commissioner as set forth in Va. Code § 58.1-624.

Local and Regional Schedules. Use Forms ST-6B and ST-6R to allocate the 1% local tax, the 0.7% Northern Virginia, Hampton Roads, and Central Virginia state

sales and use tax and the 1% Historic Triangle state sales and use tax. For the appropriate county or city, enter the total of the following items:

A.

The cost price and tax of all tangible personal property purchased tax exempt in the locality and used for a taxable purpose during the month. A purchase

made in Virginia is subject to the local tax in the county or city where the purchase was originally made.

B.

The tax due on the cost price of all tangible personal property purchased exclusive of Virginia tax outside Virginia and used for a taxable purpose during the

period. A purchase made outside Virginia is subject to local tax in the county or city where the property is used.

Additional Local Option Schedule. Use Form ST-6S for additional local option sales and use tax in the counties listed above in Line 8a.

Filing Procedure. Mail the forms with your payment to the Department of Taxation, P.O. Box 26627, Richmond, Virginia 23261-6627, or deliver to your local

Commissioner of the Revenue or Treasurer, as soon as possible after the close of the reporting period, but not later than the 20th day of the following month.

A return must be led for each reporting period even if no tax is due.

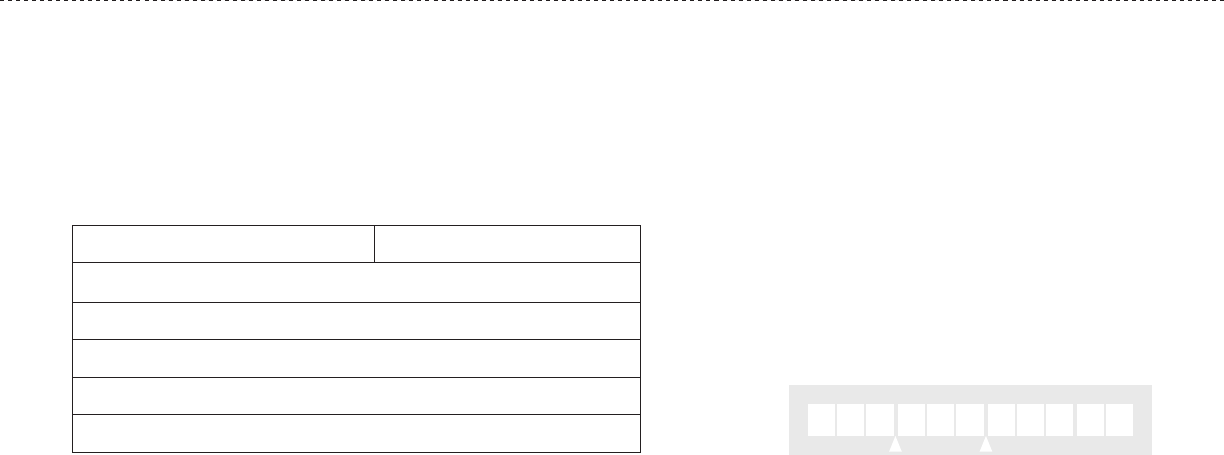

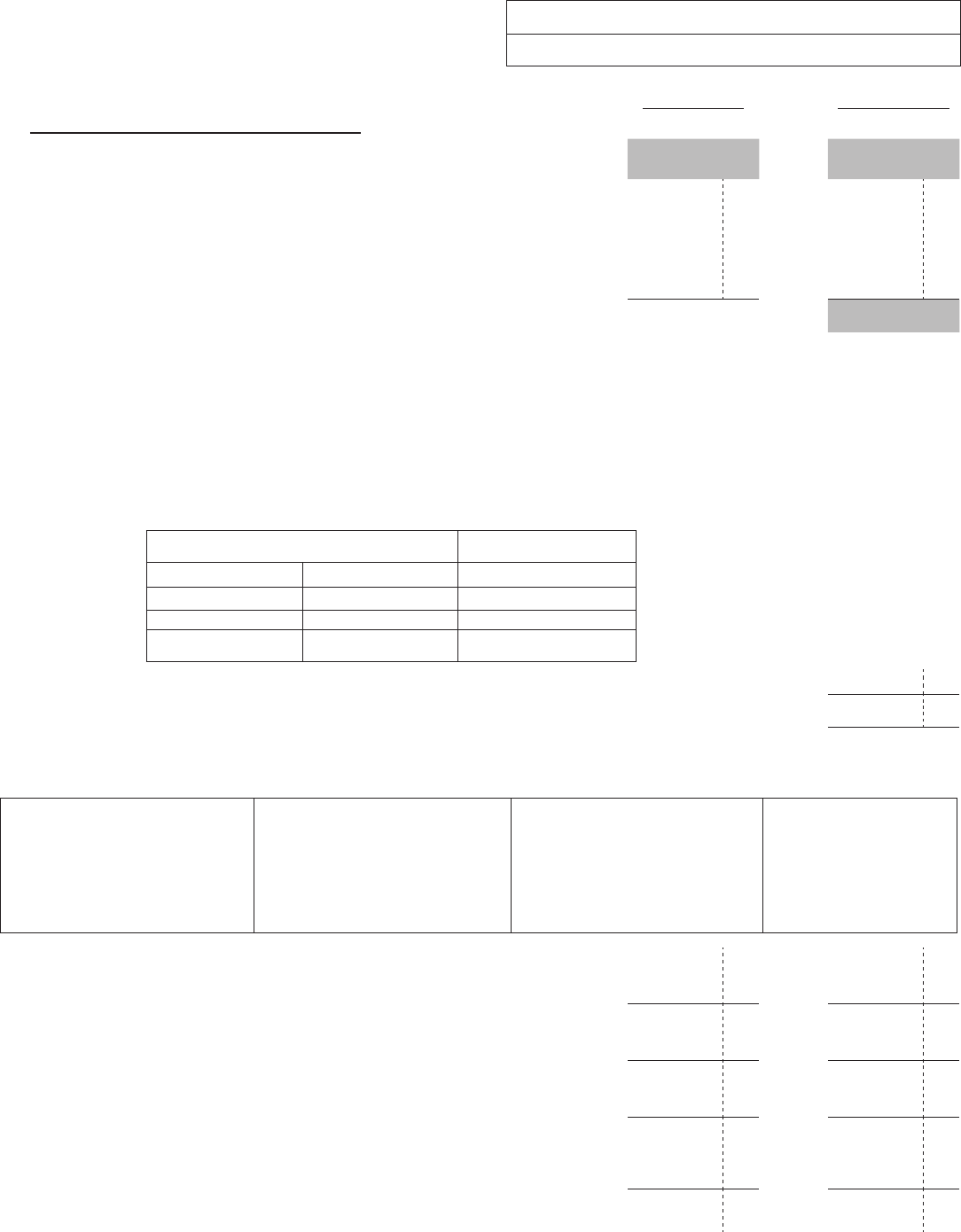

Name Account Number

10-

Address Filing Period (Enter month or quarter and year)

City, State, ZIP Code Due Date

0000000000000000 1368888 000000

ST-6V 6201041 Rev. 08/22

Form ST-6V Virginia Direct Payment Permit Sales and Use Tax Voucher

(Doc ID 136) Department Of Taxation, P.O. Box 26627, Richmond, VA 23261-6627

Total Amount Due from Form ST-6

.

If paying by check, enter the total amount due from

Form ST-6 on the Form ST-6V, and enclose this

voucher and your check with your return.

Additional Local Option Tax

Several localities have adopted an additional 1% local option sales and use tax. This tax is in addition to the one percent

general local sales and use tax authorized under current law. The additional tax will not be levied on essential personal

hygiene products or food purchased for human consumption that is taxed at a reduced rate. Refer to Form ST-9S to report

taxable sales in participating localities. More information is available on the website www.tax.virginia.gov.

Return and Payment Filing

• File and pay as soon as possible after the close of the reporting period but not later than the 20th day of the

following month. You must le a return even if no tax is due.

• Make your check payable to the Virginia Department of Taxation.

• If completed, Forms ST-6V, ST-6R, ST-6B, and ST-6S must be led with Form ST-6.

• After you have completed the return, the voucher and the schedule, mail them with your payment to:

Virginia Department of Taxation

P.O. Box 26627

Richmond, Virginia 23261-6627

Or deliver to your local Commissioner of the Revenue or Treasurer.

• DO NOT send the Worksheet (Form ST-6A) - maintain it as part of your records.

Customer Services

• For assistance, call (804) 367-8037 or write to:

Virginia Department of Taxation

P.O. Box 1115

Richmond, Virginia 23218-1115

• Please use our online services to report a change to your business or mailing address or if you discontinue business.

• Forms and instructions are available for download from the website, www.tax.virginia.gov, or by calling (804) 367-

8037.

• Tenemos servicios disponible en Español.

Period

Due Date

Account Number

10-

Name

Address

City, State, ZIP Code

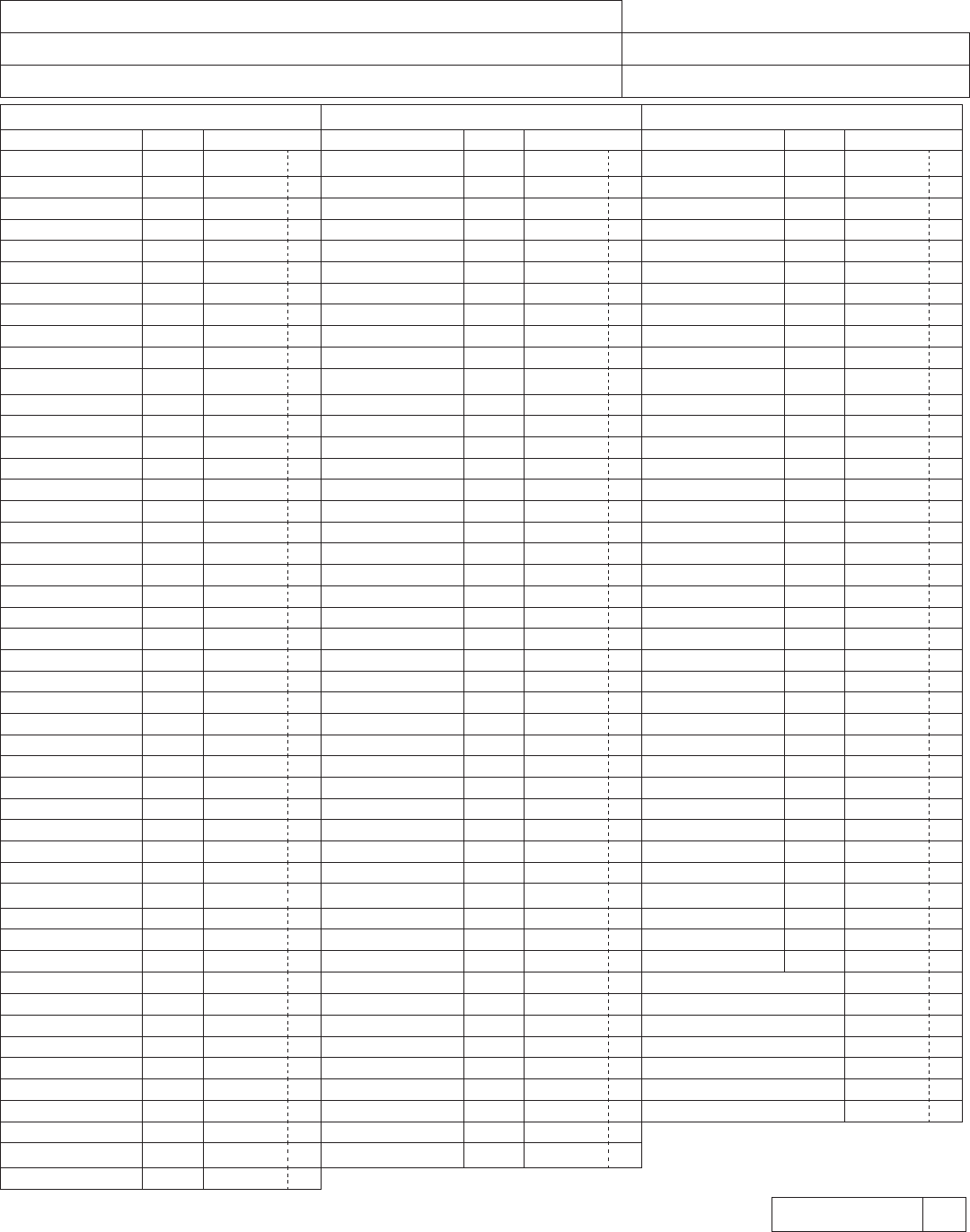

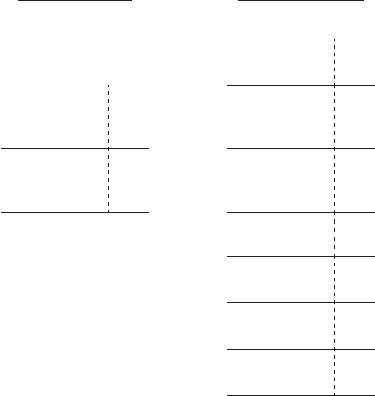

Counties Counties Cities

Locality Name Code Tax (1%) Locality Name Code Tax (1%) Locality Name Code Tax (1%)

Accomack 51001 King And Queen 51097 Alexandria 51510

Albemarle 51003 King William 51101 Bristol 51520

Alleghany 51005 Lancaster 51103 Buena Vista 51530

Amelia 51007 Lee 51105 Charlottesville 51540

Amherst 51009 Loudoun 51107 Chesapeake 51550

Appomattox 51011 Louisa 51109 Colonial Heights 51570

Arlington 51013 Lunenburg 51111 Covington 51580

Augusta 51015 Madison 51113 Danville 51590

Bath 51017 Mathews 51115 Emporia 51595

Bedford 51019 Mecklenburg 51117 Fairfax (City) 51600

Bland 51021 Middlesex 51119 Falls Church 51610

Botetourt 51023 Montgomery 51121 Franklin (City) 51620

Brunswick 51025 Nelson 51125 Fredericksburg 51630

Buchanan 51027 New Kent 51

127 Galax 51640

Buckingham 51029 Northampton 51131 Hampton 51650

Campbell 51031 Northumberland 51133 Harrisonburg 51660

Caroline 51033 Nottoway 51135 Hopewell 51670

Carroll 51035 Orange 51137 Lexington 51678

Charles City 51036 Page 51139 Lynchburg 51680

Charlotte 51037 Patrick 51141 Manassas 51683

Chestereld 51041 Pittsylvania 51143 Manassas Park 51685

Clarke 51043 Powhatan 51145 Martinsville 51690

Craig 51045 Prince Edward 51147 Newport News 51700

Culpeper 51047 Prince George 51149 Norfolk 51710

Cumberland 51049 Prince William 51153 Norton 51720

Dickenson 51051 Pulaski 51155 Petersburg 51730

Dinwiddie 51053 Rappahannock 51157 Poquoson 51735

Essex 51057 Richmond (County) 51159 Portsmouth 51740

Fairfax (County) 51059 Roanoke (County)

51161 Radford 51750

Fauquier 51061 Rockbridge 51163 Richmond (City) 51760

Floyd 51063 Rockingham 51165 Roanoke (City) 51770

Fluvanna 51065 Russell 51167 Salem 51775

Franklin (County) 51067 Scott 51169 Staunton 51790

Frederick 51069 Shenandoah 51171 Suolk 51800

Giles 51071 Smyth 51173 Virginia Beach 51810

Gloucester 51073 Southampton 51175 Waynesboro 51820

Goochland 51075 Spotsylvania 51177 Williamsburg 51830

Grayson 51077 Staord 51179 Winchester 51840

Greene 51079 Surry 51181

Greensville 51081 Sussex 51183

Halifax 51083 Tazewell 51185

Hanover 51085 Warren 51187

Henrico 51087 Washington 51191

Henry 51089 Westmoreland 51193

Highland 51091 Wise 51195

Isle Of Wight 51093 Wythe 51197

James City 51095 York 51199

King George 51099

Form ST-6B Virginia Schedule of Local Taxes

*VAST6B113888*

ST-6B 6201044 Rev. 03/13

Enter Total Local Taxes

Name

Address Account Number

City, State, ZIP Code Filing Period

*VAST6R120888*

Form ST-6R

Form ST-6R 6201042 Rev. 03/20

• For assistance, call (804) 367-8037.

• Complete this form if you le Form ST-6B and purchased or used taxable items in any of the Northern Virginia, Hampton Roads, Central Virginia, or Historic Triangle localities listed

below.

• Transfer Cost Price amounts from the Form ST-6R to the corresponding Lines 6a, Column A; 6b, Column A; 6c, Column A ; and 6d, Column A on the return.

• Transfer Total Tax amounts from the Form ST-6R to the corresponding Lines 6a, Column B; 6b, Column B; 6c, Column B; and 6d, Column B on the return.

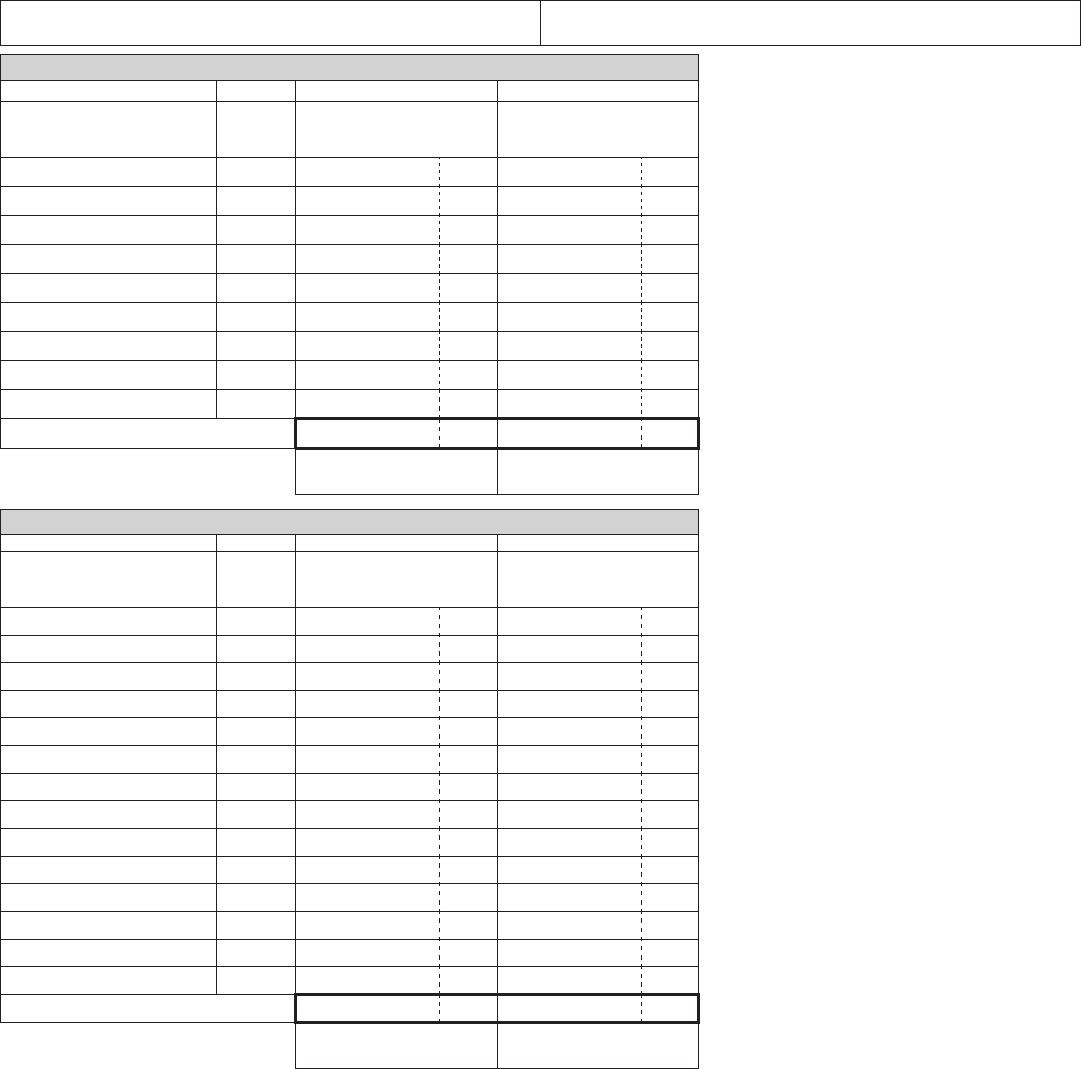

Account Number Due Date

Northern Virginia Region

A B C D

Locality Name Code

Cost Price

Allocate Line 2, Column A of

the return to each locality

Tax (0.7%)

Alexandria City 51510

Arlington County 51013

Fairfax City 51600

Fairfax County 51059

Falls Church City 51610

Loudoun County 51107

Manassas City 51683

Manassas Park City 51685

Prince William County 51153

Total Northern Virginia

Transfer this amount to Line 6a,

Column A on the return.

Transfer this amount to Line 6a,

Column B on the return.

Hampton Roads Region

A B C D

Locality Name Code

Cost Price

Allocate Line 2, Column A of

the return to each locality

Tax (0.7%)

Chesapeake City 51550

Franklin City 51620

Hampton City 51650

Isle of Wight County 51093

James City County 51095

Newport News City 51700

Norfolk City 51710

Poquoson City 51735

Portsmouth City 51740

Southampton County 51175

Suffolk City 51800

Virginia Beach City 51810

Williamsburg City 51830

York County 51199

Total Hampton Roads

Transfer this amount to Line 6b,

Column A on the return.

Transfer this amount to Line 6b,

Column B on the return.

Virginia Schedule of Regional State Sales

and Use Tax

Form ST-6S 6201040 Rev. 3/20

Central Virginia Region

A B C D

Locality Name Code

Cost Price

Allocate Line 2, Column A of

the return to each locality

Tax (0.7%)

Charles City County 51036

Chestereld County 51041

Goochland County 51075

Hanover County 51085

Henrico County 51087

New Kent County 51127

Powhatan County 51145

Richmond City 51760

Total Central Virginia

Transfer this amount to Line 6c,

Column A on the return

Transfer this amount to Line 6c,

Column B on the return

Historic Triangle Region

A B C D

Locality Name Code

Cost Price

Allocate Line 2, Column A of

the return to each locality.

Tax (1%)

James City County 51095

Williamsburg City 51830

York County 51199

Total Historic Triangle

Transfer this amount to Line 6d,

Column A on the return

Transfer this amount to Line 6d,

Column B on the return.

Important

All taxable purchases reported in Column C here

should also be included in the cost price reported

for the corresponding locality in Column C of the

Hampton Roads section above.

Form ST-6R

Page 2

Virginia Schedule of Regional State Sales

and Use Tax

*VAST6R220888*

*VAST6S123888*

Form ST-6S

Account Number Due Date (20th of month following end of period)

Additional Local Option Sales and Use Tax

A B C D E F

Locality Name Code

Local Taxable Sales

Charlotte County 51037

Danville City 51590

Gloucester County 51073

Halifax County 51083

Henry County 51089

Northampton County 51131

Patrick County 51141

Total Local Option Tax

Transfer amount above to Line

8a, Col. A on the return and

worksheet.

Virginia Schedule of Additional Local

Option Sales and Use Tax

Form ST-6S 6201040 Rev. 03/22

ST-6A 6201043 Rev. 07/22

Form ST-6A Virginia Direct Payment Permit Sales and Use Tax Return Worksheet

Transfer lines from the worksheet to the corresponding line number on Form ST-6, Virginia Direct Payment Permit Sales and Use Tax Return.

Return and payment due on 20th of month following end of period.

Account Number

10-

Filing Period (Year/Month)

A-COST PRICE B-AMOUNT DUE

DIRECT PAYMENT PERMIT SALES AND USE TAX

1 RESERVED

.......................................................................................................................

1

2 Tangible Personal Property Subject to State General Sales and Use Tax Rate. Enter

in Column A the total cost price of tangible personal property purchased exclusive of Virginia

sales or use tax either within or outside the state and used or consumed for a taxable

purpose in Virginia during the period. One-half the charge for maintenance contracts that

provide for both parts and labor is exempt. Include on this line 50% of the cost price of

such contracts purchased during this period. Multiply Column A by the rate of 4.3% (.043)

and enter the result in Column B..

..................................................................................... 2 x .043 =

3 RESERVED

................................................................................................................................................................. 3

4 Dealer Discount. A dealer discount may be taken only if the return and payment are submitted by the due date. If

your average monthly Retail Sales and Use Tax liability exceeds $20,000, no dealer discount is allowed. All other

dealers must use the dealer discount chart below to determine the dealer discount RATE. The tangible personal

property on Line 2 is used to determine the RATE ONLY. The dealer discount is calculated by multiplying the state

tax on Line 5, Column B by the dealer discount rate below.

Determine Monthly Taxable Sales and Dealer Discount Factor

Use Cost of Tangible Personal Property Subject to State General Sales and Use Tax Rate on Line 2 to determine

the dealer discount factor.

• If you le more than one return, use the total of taxable purchases from all locations.

• If you le on a quarterly basis, divide the taxable purchases for all locations by 3.

Cost of Tangible Personal Property Dealer Discount Factor

At Least But Less Than

$0 $62,501 .01116

$62,501 $208,001 .00837

$208,001 And Up .00558

Multiply Line 2, Column B by the appropriate factor above and enter here. ............................................................... 4

5 Net State Sales and Use Tax. Line 2, Column B minus Line 4.

................................................................................. 5

6 Additional Regional State Sales Tax. If you have taxable purchases in any locality in the Northern Virginia,

Hampton Roads, Central Virginia, or the Historic Triangle Regions (see table below), complete Lines 6a, 6b, 6c, 6d

and Form ST-6R.

Northern Virginia Region Hampton Roads Region Central Virginia Region Historic Triangle Region

Alexandria City

Arlington County

Fairfax City

Fairfax County

Falls Church City

Loudoun County

Manassas City

Manassas Park City

Prince William County

Chesapeake City

Franklin City

Hampton City

Isle of Wight County

James City County

Newport News City

Norfolk City

Poquoson City

Portsmouth City

Southampton County

Suolk City

Virginia Beach City

Williamsburg City

York County

Charles City County

Chestereld County

Goochland County

Hanover County

Henrico County

New Kent County

Powhatan County

Richmond City

James City County

Williamsburg City

York County

6a Northern Virginia. Enter in Column A the portion of Line 2, Column A sourced to

the Northern Virginia Region. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. ..................................................................................... 6a x .007 =

6b Hampton Roads. Enter in Column A the portion of Line 2, Column A sourced to

the Hampton Roads Region. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. ..................................................................................... 6b x .007 =

6c Central Virginia. Enter in Column A the portion of Line 2, Column A sourced to

the Central Virginia Region. Multiply Column A by the rate of 0.7% (.007) and enter

the result in Column B. .............................................................................................. 6c x .007 =

6d Historic Triangle. Enter in Column A the portion of Line 2, Column A sourced to

the Historic Triangle Region. All taxable sales reported here in Column A should

also be included in the taxable sales reported in Column A of Line 6b. Multiply

Column A by the rate of 1.0% (.01) and enter the result in Column B. ...................... 6d x .01 =

A-COST PRICE B-AMOUNT DUE

7 Total State and Regional Tax. Add Line 5; Line 6a, Column B; Line 6b, Column B; Line 6c, Column B; and

Line 6d, Column B ....................................................................................................................................................... 7

8 Local Sales and Use Tax. Enter cost of tangible personal property subject to Local

Sales and Use Tax in Column A. Multiply Column A by the rate of 1.0% (.01) and enter

the result in Column B. Complete Form ST-6B.

................................................................ 8 x .01 =

8a Additional Local Option Tax. Enter cost of tangible personal property subject to

Additional Local Option Tax in Column A. Multiply Column A by the rate of 1.0% (.01)

and enter the result in Column B. Complete Form ST-6S.

................................................ 8a x .01=

9 Total Tax. Add Lines 7, 8, and 8a in Column B.

.......................................................................................................... 9

10 Penalty. Penalty is 6% of Line 9 for each month or part of a month the tax is not paid, not to exceed 30%. The

minimum payment is $10.00, even if the tax due is $0.

................................................................................................ 10

11

Interest. Interest is assessed on Line 9 at the rate established in Section 6621 of the Internal Revenue Code of

1954, as amended, plus 2%. For interest rates visit www.tax.virginia.gov. .............................................................. 11

12 Total Amount Due. Add Lines 9, 10 and 11.

.............................................................................................................. 12

Do not mail this worksheet. Keep for your records.