WEST VIRGINIA STATE

FREIGHT PLAN

Air Cargo Profile

November 2023

Tech Memo

West Virginia State Freight Plan

Air Cargo Profile

prepared by

Cambridge Systematics, Inc.

with

Mott MacDonald

date

November 2023

Air Cargo Profile

West Virginia Department of Transportation

i

TABLE OF CONTENTS

1.0 Introduction ............................................................................................................................................ 5

1.1 Overview of the Plan ...................................................................................................................... 5

1.2 West Virginia Freight Transportation Vision and Goals ................................................................. 6

1.3 Aviation Profile Overview ............................................................................................................... 6

2.0 Air Cargo Network Inventory ................................................................................................................ 7

2.1 Overview of Cargo Airports in West Virginia.................................................................................. 7

2.1.1 Airport Profiles ................................................................................................................ 10

2.2 West Virginia Air Cargo Service Classification Types ................................................................. 14

2.2.1 Dedicated Air Cargo........................................................................................................ 14

2.2.2 Integrator ......................................................................................................................... 14

2.2.3 Belly Cargo ..................................................................................................................... 15

2.2.4 U.S. Mail ......................................................................................................................... 16

2.3 Other Air Cargo Gateways ........................................................................................................... 16

3.0 Air Cargo Demand ................................................................................................................................ 18

3.1 Total Air Freight Demand ............................................................................................................. 18

3.2 Future of Aviation Trends ............................................................................................................ 21

3.2.1 Aircraft and Airport Technology ...................................................................................... 22

3.2.2 Economic Trends ............................................................................................................ 22

3.2.3 Advanced Air Mobility, Urban Air Mobility, and Unmanned Aircraft Systems ................. 23

3.2.4 Aviation Safety and Security ........................................................................................... 23

3.2.5 Response to the COVID-19 Pandemic ........................................................................... 24

4.0 Condition and Performance ................................................................................................................ 25

4.1 Road Network Access.................................................................................................................. 25

4.1.1 BKW ................................................................................................................................ 25

4.1.2 CKB ................................................................................................................................. 26

4.1.3 LWB ................................................................................................................................ 27

4.1.4 CRW ............................................................................................................................... 28

4.1.5 HTS ................................................................................................................................. 29

4.2 Capacity ....................................................................................................................................... 30

4.3 Conclusions ................................................................................................................................. 30

Air Cargo Profile

West Virginia Department of Transportation

ii

Air Cargo Profile

West Virginia Department of Transportation

iii

LIST OF TABLES

Table 2-1 West Virginia Airport Key Statistics .......................................................................................... 8

Table 2-2: Other West Virginia Airports ................................................................................................... 13

Air Cargo Profile

West Virginia Department of Transportation

iv

LIST OF FIGURES

Figure 1-1 West Virginia State Freight Plan Technical Activities ............................................................... 5

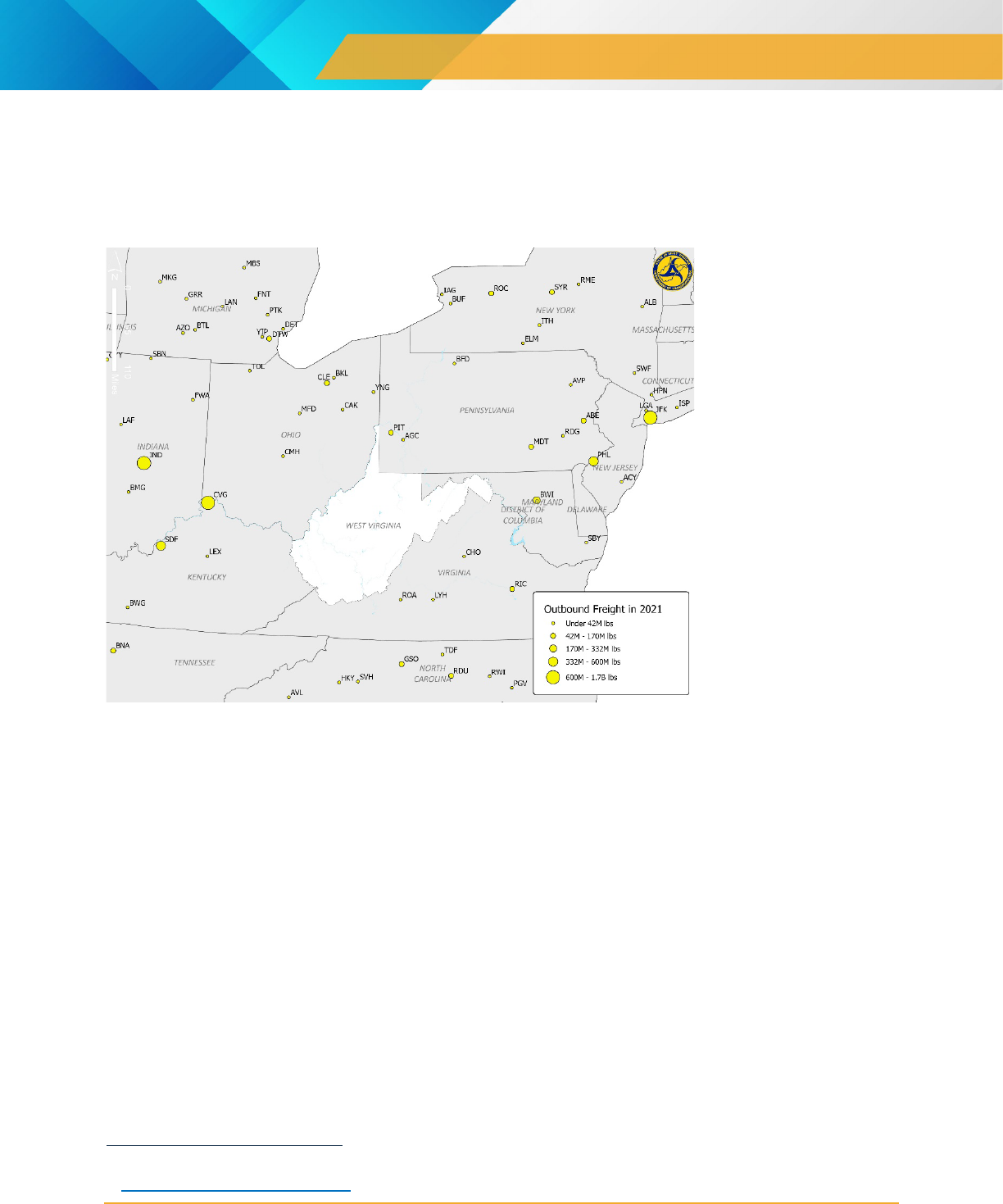

Figure 2-1 West Virginia Major Airports ..................................................................................................... 7

Figure 2-2 Beckley Raleigh County Memorial Airport (BKW) .................................................................. 10

Figure 2-3 Greenbrier Valley Airport (LWB) ............................................................................................. 11

Figure 2-4 Huntington Tri-State Airport (HTS) ......................................................................................... 11

Figure 2-5 North Central West Virginia Airport (CKB).............................................................................. 12

Figure 2-6 West Virginia International Yeager Airport (CRW) ................................................................. 13

Figure 2-7 Amazon Freight Coverage Map .............................................................................................. 15

Figure 2-8 Freight Airports near West Virginia ......................................................................................... 17

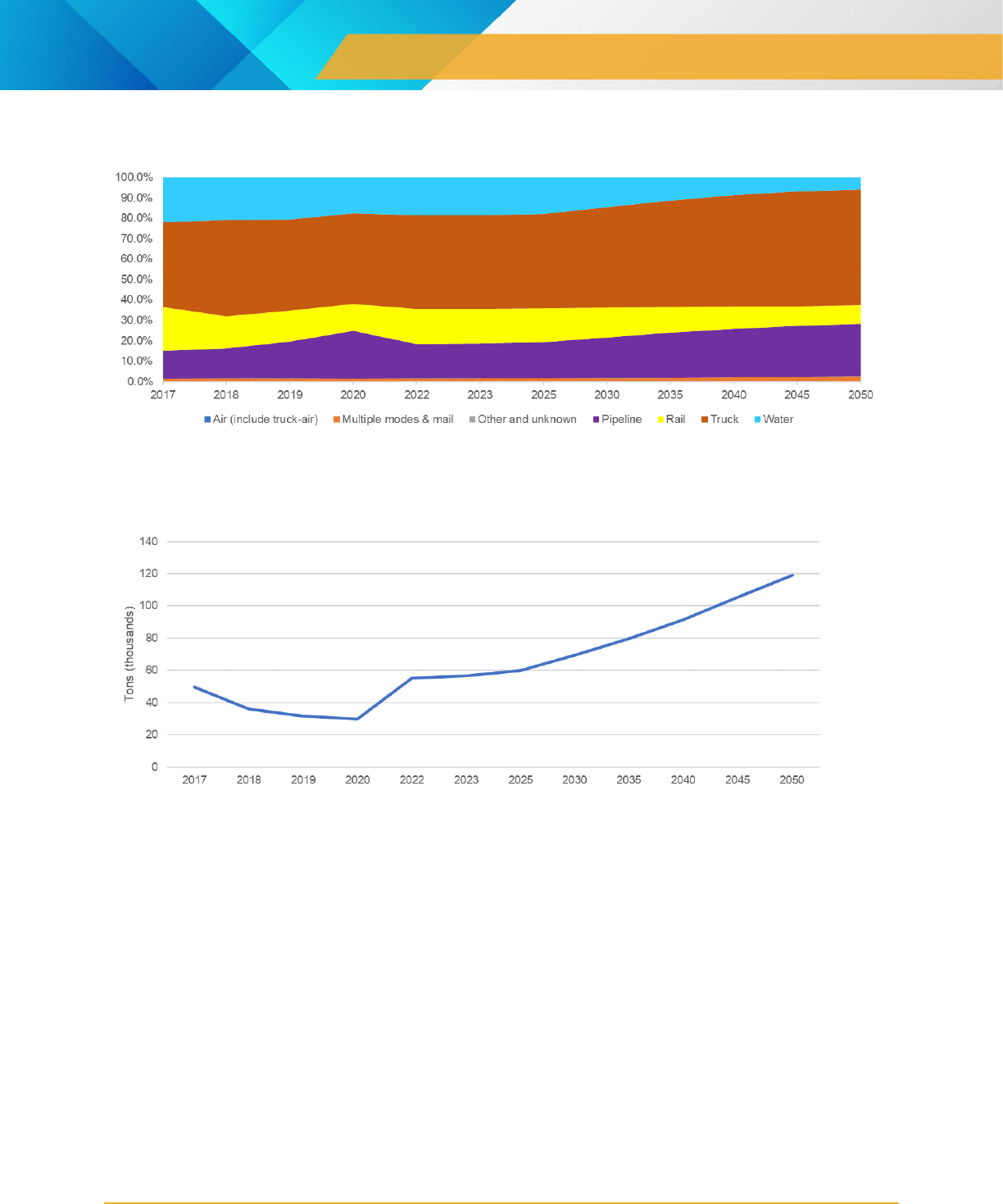

Figure 3-1 Share of Two-Way Freight Transport Modes by Tonnage in West Virginia, 2017

Projected through 2050 .......................................................................................................... 19

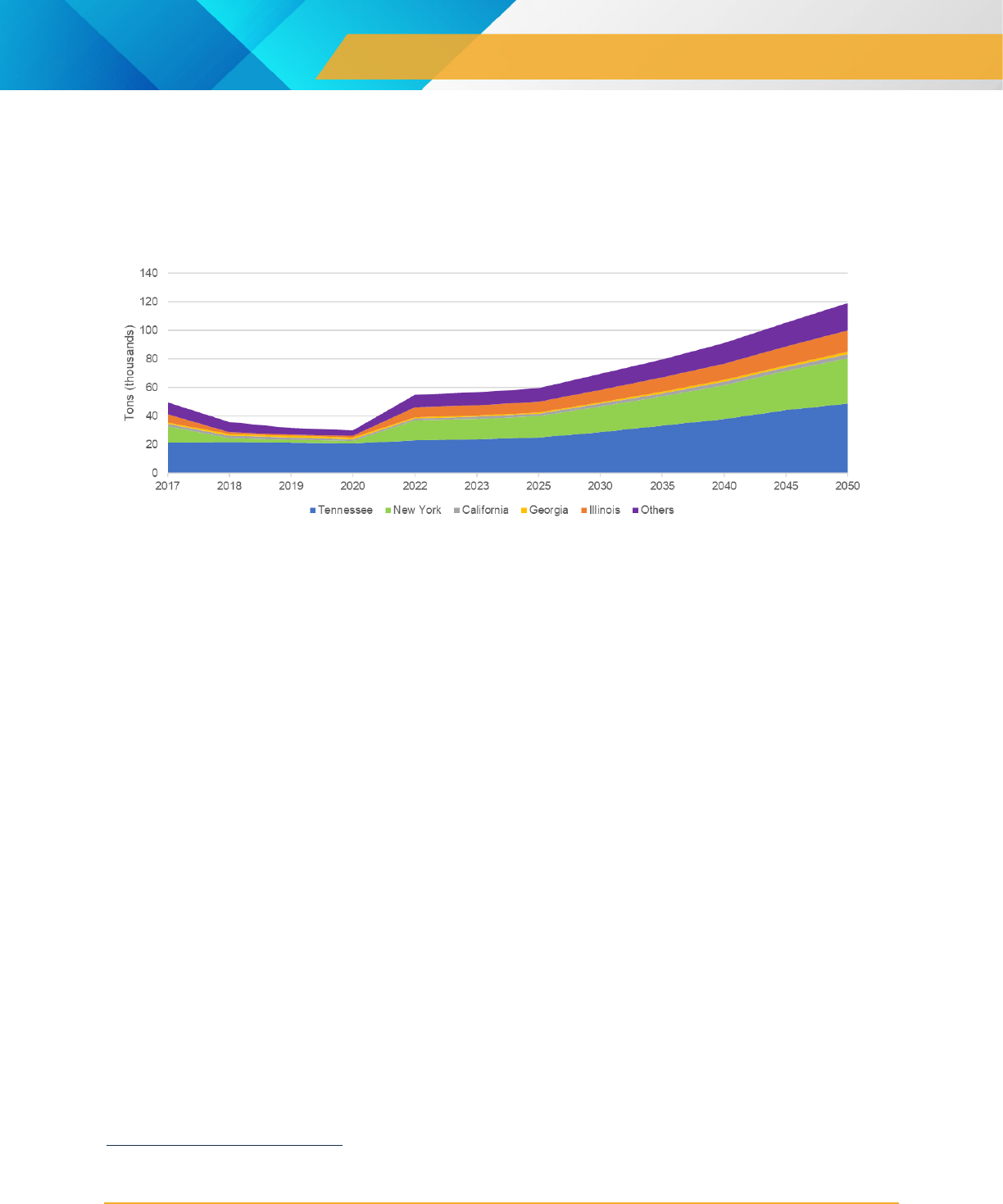

Figure 3-2 Two-Way Air Freight Tonnage in West Virginia, 2017 through 2050 ..................................... 19

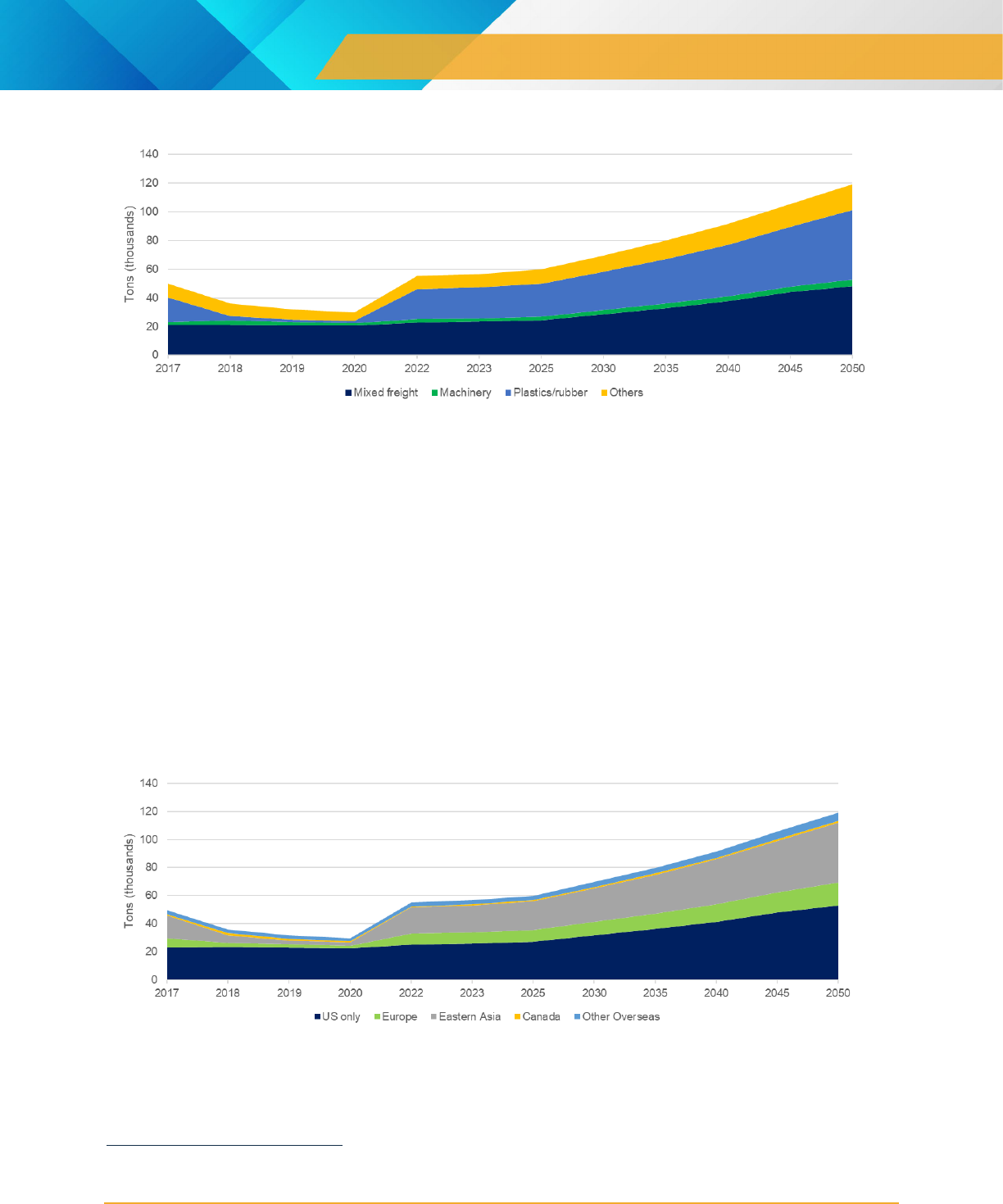

Figure 3-3 Air Freight Commodities to and from West Virginia 2017 through 2050 ................................ 20

Figure 3-4 Ultimate Origins and Destinations of Air Freight to and from West Virginia 2017

through 2050 ........................................................................................................................... 20

Figure 3-5 Domestic Origins and Destinations (U.S. States) of Air Freight to and from West

Virginia 2017 through 2050 .................................................................................................... 21

Figure 4-1 BKW Airport ............................................................................................................................ 26

Figure 4-2 CKB Airport ............................................................................................................................. 27

Figure 4-3 LWB Airport ............................................................................................................................ 28

Figure 4-4 CRW Airport ............................................................................................................................ 29

Figure 4-5 HKS Airport ............................................................................................................................. 30

Air Cargo Profile

West Virginia Department of Transportation

5

1.0 INTRODUCTION

1.1 Overview of the Plan

In 2022, the West Virginia Department of Transportation (WVDOT) began its update of the West Virginia

State Freight Plan. This Plan will fulfill federal requirements for state freight planning, identify opportunities

for West Virginia to invest in its freight system, and position WVDOT to take full advantage of federal formula

and discretionary funding programs for freight transportation investments. Additionally, the Plan will detail

freight activity, needs, and priorities, and support WVDOT in meeting the agency’s overall goals as well as

those of this Plan.

The purpose of this Air Cargo Profile is to identify West Virginia’s existing air cargo assets and air cargo

demand and assess their performance and condition. Documenting existing challenges helps identify

strategies and solutions to aid the state going forward and is one of many complementary technical activities

that will be developed as part of this planning process. The overall process is shown in Figure 1-1, and will

be developed in conjunction with a robust stakeholder engagement effort that will support the data driven

aspects of this Plan.

Figure 1-1 West Virginia State Freight Plan Technical Activities

Review and

Coordination

Review of

Existing Plans

Data Needs

Assessment

State of the

System

Modal

Profiles

Commodity Flow

Profile

Economic and

Industry Trends

Strategic

Direction

Freight Vision,

Goals and

Objectives

Freight Needs

Assessment

Environmental

and Equity

Impacts

Performance

Measures

Priorities and

Implementation

Freight

Strategies

Freight

Investment Plan

Implementation

Plan

Stakeholder Engagement

Air Cargo Profile

West Virginia Department of Transportation

6

1.2 West Virginia Freight Transportation Vision and Goals

The vision of the West Virginia State Freight Plan is as follows:

WVDOT will achieve this vision through the following goals:

• System Condition, Efficiency, and Fiscal Sustainability: Maintain multimodal and intermodal freight

transportation infrastructure in a state of good repair and manage lifecycle costs; efficiently deliver

projects, programs and services supporting goods movement; and work to maintain existing funding

mechanisms while exploring new alternative and sustainable funding mechanisms.

• Safety and Security for All Users: Reduce transportation fatalities and serious injuries involving freight

vehicles, improve the safety and security of drivers, cargo, and intermodal facilities, and improve the

resilience of the freight system particularly to severe weather events and other disruptions.

• Economic Vitality: Strengthen the ability of communities and industries to access national and

international trade markets, retain and grow existing WV statewide and regional economic focus sectors,

and support regional economic development that will diversity WV's economy.

• Multimodal Mobility, Reliability, and Accessibility: Facilitate freight mobility and connections for

on-demand and reliable goods delivery across all West Virginia communities, including critical services

such as health care and emergency management.

• Livable and Healthy Communities: Create freight transportation systems that operate efficiently and

cleanly, protect the natural environment and maintain access for residents and visitors to experience

WV's natural and cultural destinations.

1.3 Aviation Profile Overview

This technical memorandum is organized as follows:

• Section 2.0 – Air Cargo Network Inventory

• Section 3.0 – Air Cargo Demand

• Section 4.0 – Condition and Performance

THE WEST VIRGINIA DEPARTMENT OF TRANSPORTATION'S MISSION IS TO RESPONSIBLY

PROVIDE A SAFE, EFFICIENT AND RELIABLE TRANSPORTATION SYSTEM THAT SUPPORTS

ECONOMIC OPPORTUNITY AND QUALITY OF LIFE.

Air Cargo Profile

West Virginia Department of Transportation

7

2.0 AIR CARGO NETWORK INVENTORY

2.1 Overview of Cargo Airports in West Virginia

Aviation is critical to West Virginia’s economy and its residents’ way of life. While passenger traffic is often

the most visible part of a state’s aviation system, airports also connect air cargo markets, allow for expedited

mail and package delivery, and support real-time freight solutions such as rush order shipments of critical

equipment or parts. Airport passenger service also plays a role in air cargo, as scheduled airline services

often accommodate small amounts of freight in what is referred to as "belly cargo.”

There are 23 airports in the state of West Virginia. Five airports handled air cargo between 2016 to 2021,

according to the Bureau of Transportation Statistics (BTS) T-100 data (see Figure 2-1): Huntingdon Tri-State

International Airport (HTS); Beckley Raleigh County Memorial Airport (BKW); North Central West Virginia

Airport (CKB); Greenbrier Valley Airport (LWB); and West Virginia International Yeager Airport (CRW).

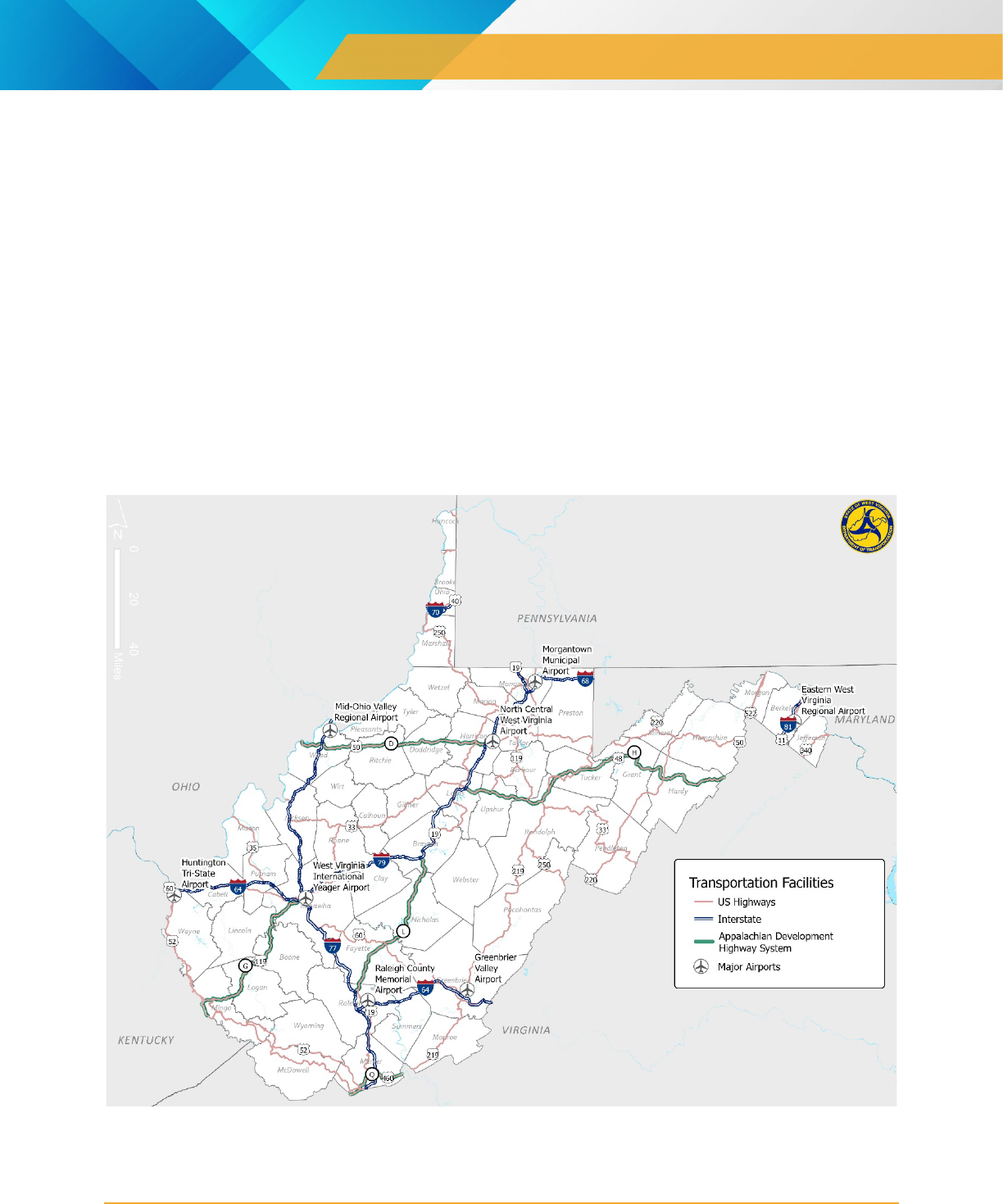

Figure 2-1 West Virginia Major Airports

Source: West Virginia GIS Data

Air Cargo Profile

West Virginia Department of Transportation

8

When compared to international or national gateways, the volume of traffic, both passenger and freight, at

West Virginia airports is proportionately small with many of the airports being designated either a Small or

Non-Hub facility by the U.S. Federal Aviation Administration (FAA)

1

. Air cargo moving through West

Virginia’s airports is primarily transported by small cargo aircraft and/or as belly cargo. Table 2-1 West

Virginia Airport Key Statistics summarize the volumes of air freight and passengers, as well as the number of

passenger and air cargo carriers at each of the five airports.

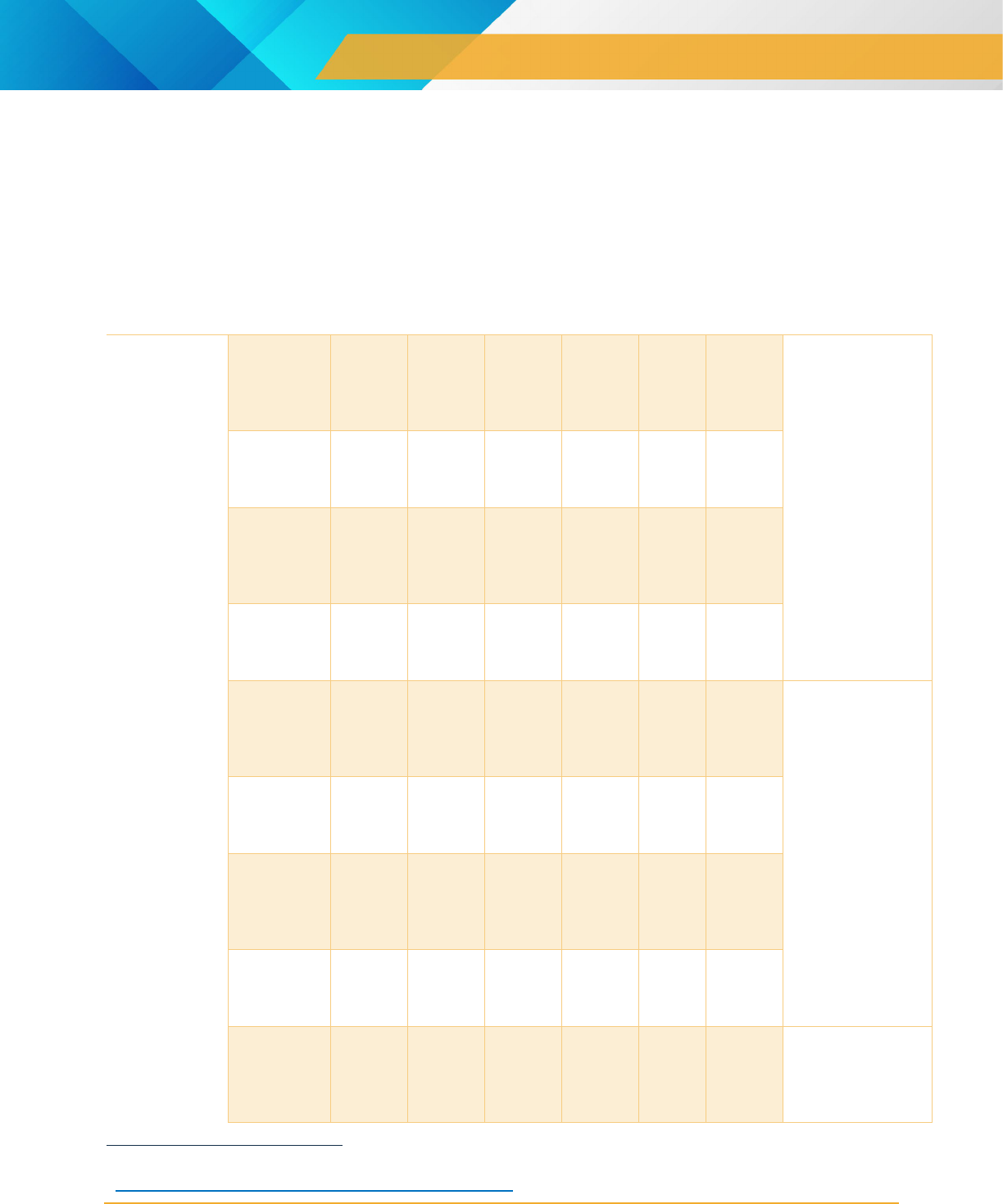

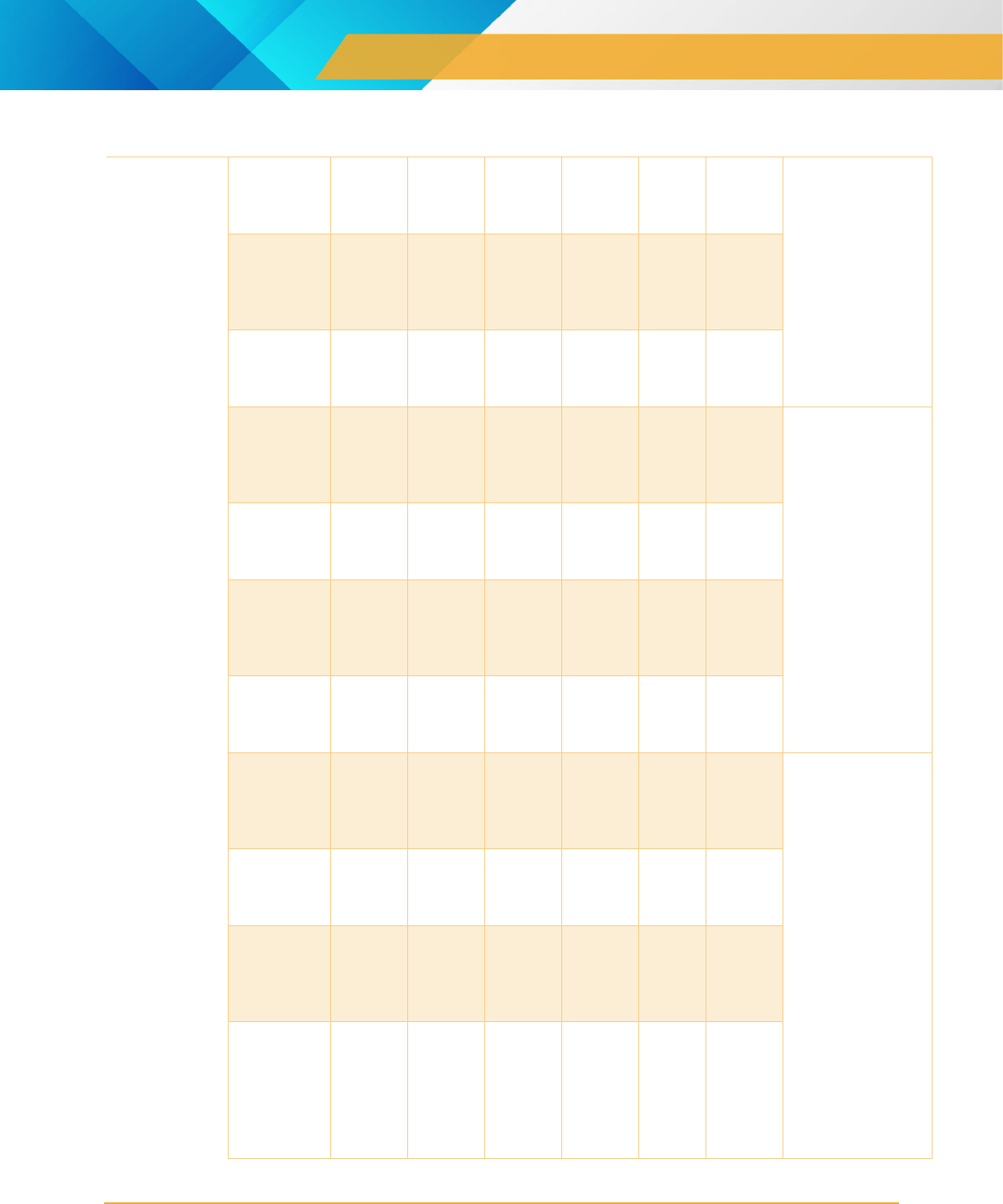

Table 2-1 West Virginia Airport Key Statistics

2016

2017

2018

2019

2020

2021

Comments

Beckley

Raleigh

County

Memorial

Airport

(BKW)

Total

enplaned

air freight

tonnage

143

169

157

160

133

148

The passenger

growth at BKW is

likely due to new

service added by

Contour Airlines,

who transported 21

outbound

passengers in

2017, 839 in 2018,

8,669 in 2019,

5,002 in 2020, and

9,987 in 2021.

Total

enplaned

passengers

2,251

1,539

2,468

8,669

5,002

9,987

Total

deplaned

air freight

tonnage

0

0

0

0.6

0

0

Total

deplaned

passengers

1,815

1,517

1,927

4,993

3,023

7,254

Greenbrier

Valley

Airport

(LWB)

Total

enplaned

air freight

tonnage

9

15

5

0

7

6

Generally, all freight

activity for the

airport is driven by

United Airlines. In

2018, United

decreased service

at LWB and

SkyWest operated

on their behalf in

2019.

Total

enplaned

passengers

5,285

5,448

10,035

12,727

3,986

10,905

Total

deplaned

air freight

tonnage

7

14

4

0

7

6

Total

deplaned

passengers

5,758

5,421

10,566

12,776

3,878

11,159

Huntington

Tri-State

International

Airport (HTS)

Total

enplaned

air freight

tonnage

4,274

4,254

4,175

3,899

3,802

3,542

HTS saw a

decrease in

passenger and

1

Airport Categories | Federal Aviation Administration (faa.gov)

Air Cargo Profile

West Virginia Department of Transportation

9

2016

2017

2018

2019

2020

2021

Comments

Total

enplaned

passengers

98,480

103,718

101,649

108,513

58,577

94,970

freight activity in

2020 due to

COVID-19, which

restabilized in 2021.

Total

deplaned

air freight

tonnage

7,037

6,801

7,101

9,015

7,215

7,058

Total

deplaned

passengers

95,791

100,887

99,088

106,847

57,747

93,532

North

Central

West Virginia

Airport

(CKB)

Total

enplaned

air freight

tonnage

15

18

22

18

16

15

CKB saw a

decrease in

passenger activity

in 2020 due to

COVID-19, which

restabilized in 2021.

Total

enplaned

passengers

25,967

25,104

36,915

41,791

18,468

37,164

Total

deplaned

air freight

tonnage

16

19

21

19

12

16

Total

deplaned

passengers

25,062

24,702

36,245

41,288

18,586

36,473

West Virginia

International

Yeager

Airport

(CRW)

Total

enplaned

air freight

tonnage

95

20

17

72

8

5

CRW saw a

decrease in

enplaned air freight

tonnage in 2017 –

USA Jet Airlines

handled 43 tons of

freight in 2016 and

did not operate in

CRW in 2017 or

2018.

CRW saw a

threefold increase

in enplaned

tonnage in 2019

likely due to the

return of USA Jet

Airlines.

Total

enplaned

passengers

213,408

202,777

216,364

226,104

91,935

148,879

Total

deplaned

air freight

tonnage

311

301

334

281

297

219

Total

deplaned

passengers

212,275

202,633

214,919

223,585

90,855

147,602

Source: Bureau of Transportation statistics, T-100 Market (All Carriers)

Air Cargo Profile

West Virginia Department of Transportation

10

2.1.1 Airport Profiles

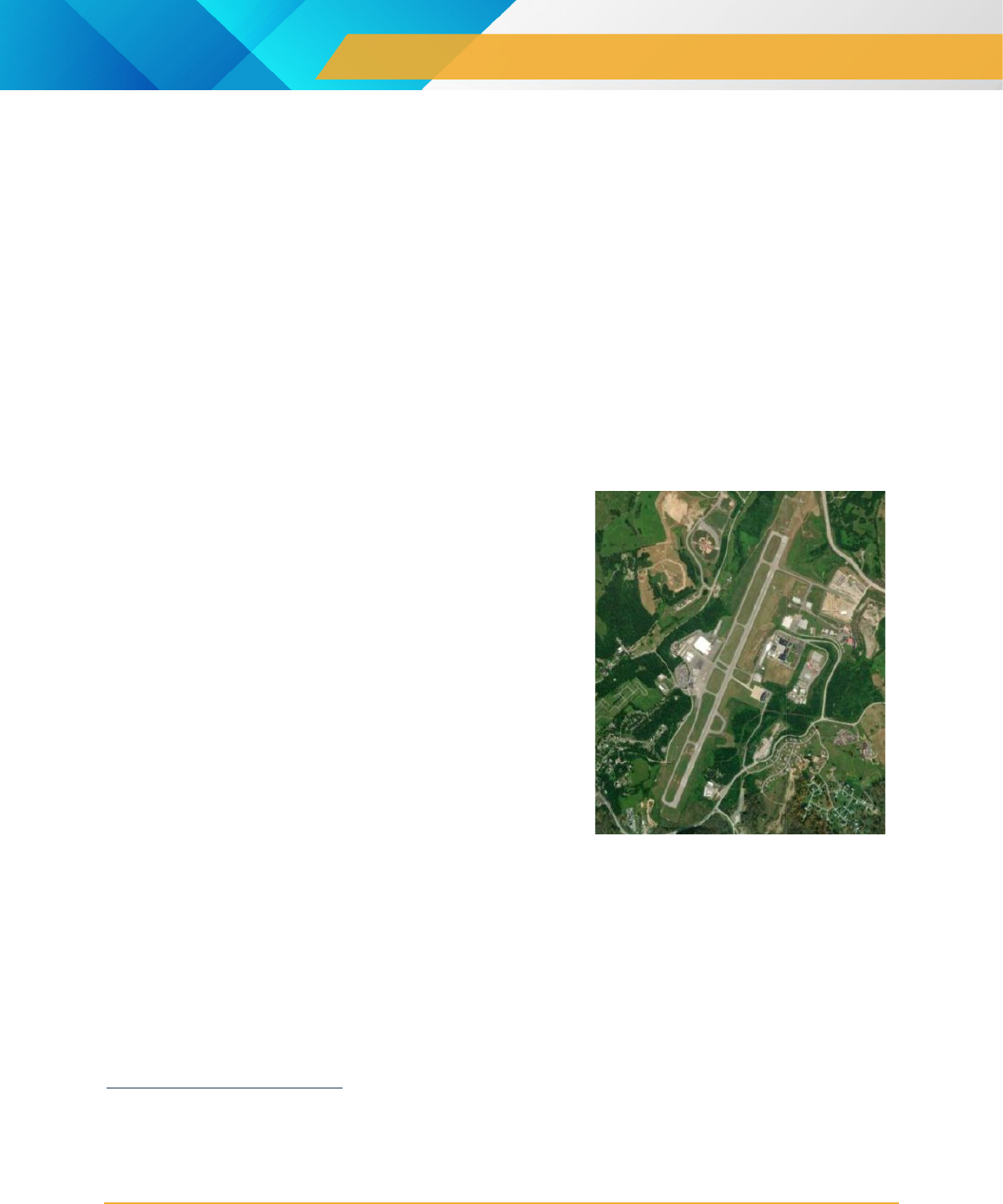

Beckley Raleigh County Memorial Airport

(BKW)

BKW is located approximately four miles east of

Beckley, West Virginia. The airport is owned and

operated by the Raleigh County Airport Authority and

covers an area of 1,433 acres with two perpendicular

runways, RWY1/19 (6,750 feet) running north-south

and RWY10/28 (5,001 feet) running east-west. Major

highways are located close, and connect the airport to

the rest of the state, including I-64 and north-south

running U.S. 19 from Erie, Pa. to Memphis, Fla. In close

proximity running from Cleveland, Ohio to Columbia,

S.C. is I-77.

The airport processed 148 tons of enplaned freight and

no deplaned freight in 2021,

2

with FedEx as the only

operator (FedEx services at BKW are operated by

Mountain Air Cargo, with ATR-42 and ATR-72

equipment). The FedEx Ship Center (which offers

shipping and postal services) is located on the eastern

side of the airport next to RWY1/19. In recent years,

BKW was awarded grants from the FAA. In October

2021, $2.9 million was awarded to go towards taxiway

construction works and in March 2023, $1.0 million was

awarded to expand the passenger terminal to

accommodate a 50-seat hold room, accessible rest

rooms, and several other sustainable design concepts

to enhance energy efficiency.

Passenger services at the airport are limited, with Contour Airlines offering flights as public charters on

Embraer 135 and Embraer 145 aircraft.

2

Bureau of Transportation Statistics, T-100 data

Figure

2-2 Beckley Raleigh County Memorial

Airport (BKW)

Source: Esri ArcGIS

Air Cargo Profile

West Virginia Department of Transportation

11

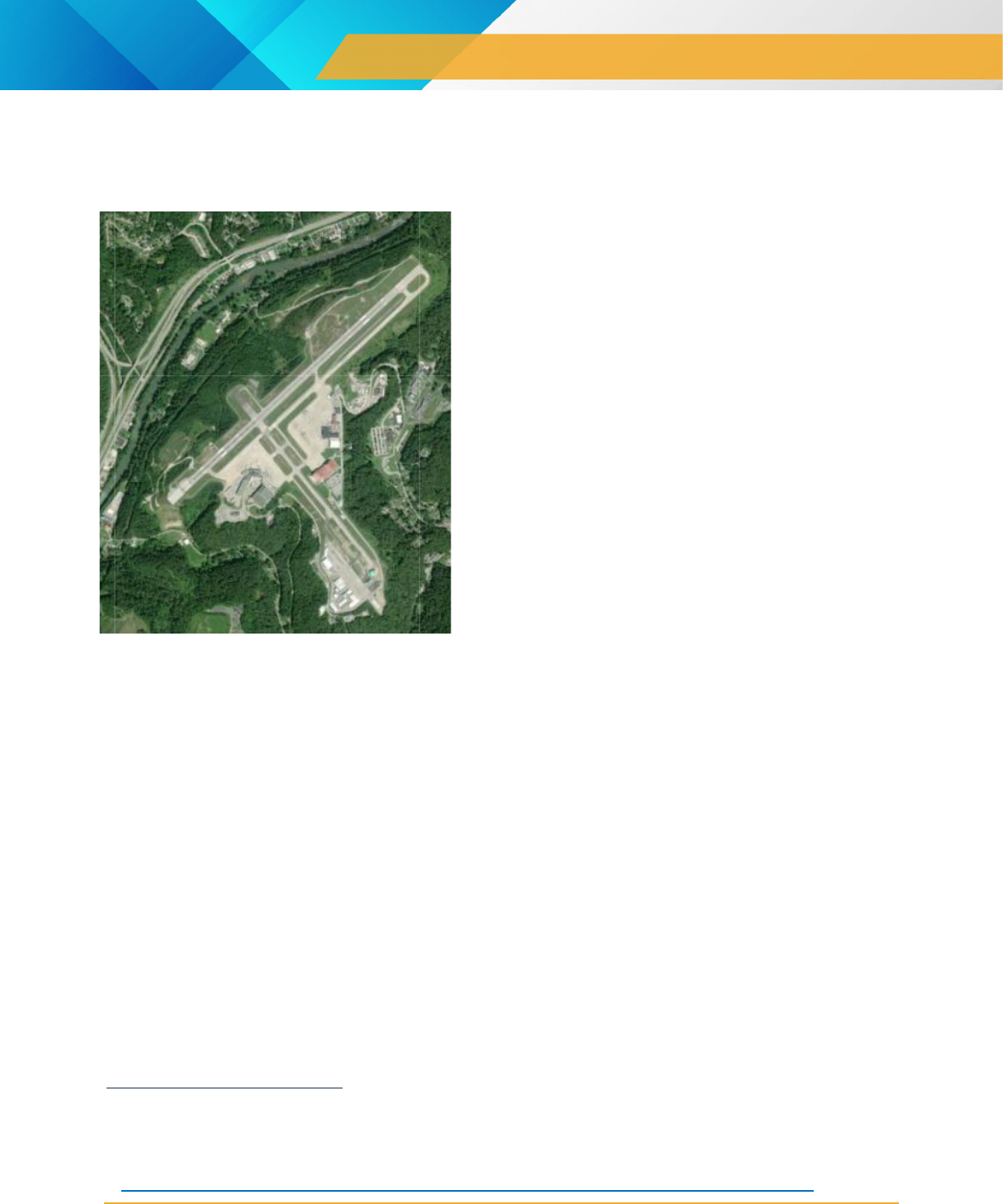

Greenbrier Valley Airport (LWB)

LWB is located approximately four miles northeast of

Lewisburg, West Virginia. It has one 7,003-foot

runway and occupies 472 acres of land. The airport

is connected with U.S. 219 intersecting with I-64

south of the airport. In 2021, only six tons of

enplaned air freight and six tons of deplaned air

freight was processed at LWB with United Airlines as

the sole operator utilizing belly cargo hold of

passenger aircraft.

3

The airport handled 10,905 departing passengers

during 2021.

4

United Airlines stopped serving the

airport during 2022. In December 2022, Contour

Airlines launched a service providing 12 trips per

week to Charlotte, using Embraer 135 and Embraer

145 aircraft.

LWB was awarded a $4.6 million FAA grant in

November 2022 to construct and renovate buildings

to house and maintain snow removal equipment.

Huntington Tri-State International Airport (HTS)

HTS is located approximately

six miles southwest of

Huntington, West Virginia. The

airport serves three states,

given its location near West

Virginia’s borders with Kentucky

and Ohio. The airport is owned

and operated by the Tri-State

Airport Authority, which includes

members from West Virginia,

Kentucky, and Ohio, and covers

an area of 1,300 acres with a

single 7,017-foot runway. The

airport is located near several

major highways, including U.S.

52 which runs from Portal, North

Dakota to Charleston, South

Carolina, as well as I-64 which runs east-west from Chesapeake, Virginia to Wentzville, Missouri.

3

Bureau of Transportation Statistics, T-100 data

4

Bureau of Transportation Statistics, T-100 data

Figure

2-3 Greenbrier Valley Airport (LWB)

Source: Esri ArcGIS

Figure

2-4 Huntington Tri-State Airport (HTS)

Source: Esri ArcGIS

Air Cargo Profile

West Virginia Department of Transportation

12

In 2021, HTS handled 3,542 tons of enplaned freight and 7,058 tons of deplaned freight. FedEx is the main

operator, handling 3,507 tons of enplaned freight, (approximately 99% of all enplaned freight at this airport).

5

The other two airlines providing freight services are Atlas and Piedmont Airlines (operating on behalf of

American Airlines). FedEx operates the only Boeing 757 hub in West Virginia at HTS,

6

with its ship center

located at the northern side of the airport. This airport is the largest in the state in terms of enplaned freight in

2021.

HTS handled 95,000 departing passengers in 2021. Passenger services are operated by American Airlines

(to Charlotte, primarily on Embraer E-145s), and Allegiant Air to destinations in South Carolina (Myrtle

Beach) and Florida (Destin-Fort Walton Beach, Orlando-Sanford, Punta Gorda, and St Petersburg) using

A319 and A320 equipment.

North Central West Virginia Airport (CKB)

CKB is situated approximately six miles east of Clarksburg, West

Virginia. The airport has an area of 434 acres and operates with

a single runway of 7,800 feet. The major highway connecting the

airport to Clarksburg and other parts of the state is U.S. 50.

Running from north to south on the western side of the airport, I-

79 connects Erie, Pennsylvania in the north to Charleston, West

Virginia in the south. United Airlines was the only operator

providing air freight services at CKB in 2021, which it does in the

hold of passenger aircraft. The airport processed 15 tons of

enplaned air freight and 15.75 tons of deplaned air freight in

2021.

7

Passenger services at CKB are limited. United Airlines stopped

serving the airport during 2022 and CKB Director Richard B Rock

recommended to the U.S. Department of Transportation in July

2022 that Contour Airlines be the airport’s new ‘Essential Air

Services’ carrier, operating services to Charlotte. Contour

Airlines serves the airport with Embraer 135 and Embraer 145

aircraft.

CKB was awarded grants from the FAA, including $1.2 million in October 2021 to go towards mitigating the

economic impacts of COVID-19 and improving security precautions. A further $2.5 million was awarded in

July 2022 to go towards apron and taxiway construction works, and in March 2023, $2.1 million was awarded

for the construction of a new 52,600 square-foot terminal building. The construction of the terminal was

awarded to Mascaro Construction Company in December 2022, and it is planned to feature upgraded

security checkpoints, baggage handling systems, and gates. Construction is planned to commence during

2023.

5

Bureau of Transportation Statistics, T-100 data

6

Tristateairport.com, Business Opportunities, Tri-State Aeroplex, accessed April 2023

7

Bureau of Transportation Statistics, T-100 data

Figure

2-5 North Central West

Virginia Airport (CKB)

Source: Esri ArcGIS

Air Cargo Profile

West Virginia Department of Transportation

13

West Virginia International Yeager Airport (CRW)

CRW is located approximately 2.5 miles northeast of

Charleston, West Virginia, and a range of U.S. carriers

operate a domestic route network from the airport. The

airport utilizes a single 6,715-foot runway running

northeast-southwest and occupies an area of 767 acres.

Although the airport lies besides I-77 and I-79, there are no

junctions which directly connect CRW to these interstates.

The only road access to the airport is the West Virginia

Route 114, running to Charleston. CRW processed five

tons of enplaned air freight and 219 tons of deplaned air

freight in 2021,

8

operated by PSA Airlines (operating on

behalf of American Airlines) via belly hold and ad hoc USA

Jet Airways operations with dedicated cargo aircraft.

CRW handled 149,000 departing passengers in 2021.

9

Services to the airport are provided by American Airlines (to

Charlotte and Washington DC National), Delta Air Lines (to

Atlanta), Spirit Airlines (to Orlando), and United Airlines (to

Chicago O’Hare), although Spirit Airlines announced in

March 2023 that it is to suspend services to CRW

beginning May 2023. Beginning in May 2023, Breeze

Airways began serving CRW with new nonstop flights to

Orlando, Florida (MCO) and Charleston, South Carolina

(CHS), with at least three additional destinations planned for the next two years.

10

It is anticipated that this

new service will include freight capacity and thereby provide mobility to each airport’s regional economy.

CRW was awarded FAA grants in September 2022 ($1 million for completion of an environmental impact

statement for a proposed runway safety area project), and March 2023 ($1 million to upgrade the terminal

building, including improvements to disability compliance and roof installation works).

The eighteen airports in West Virginia that did not report any air cargo activity in 2021 are shown in Table

2-2.

Table 2-2: Other West Virginia Airports

• Morgantown Municipal Airport (MGW)

• Mid-Ohio Valley Regional Airport (PKB)

• Eastern WEST VIRGINIA Regional Airport

(MRB)

• Mercer County Airport (BLF)

• Philippi/Barbour County Regional Airport (79D)

• Wyoming County Airport (Kee Field) (I16)

• Mason County Airport (3I2)

• Jackson County Airport (I18)

8

Mott MacDonald analysis of Bureau of Transportation Statistics, T-100 data

9

Mott MacDonald analysis of Bureau of Transportation Statistics, T-100 data

10

Breeze Airways to connect CRW to at least 5 new destinations - West Virginia International Yeager Airport

Source: Esri ArcGIS

Figure

2-6 West Virginia International

Yeager Airport (CRW)

Air Cargo Profile

West Virginia Department of Transportation

14

• Upshur County Regional Airport (W22)

• Elkins-Randolph County Airport (EKN)

• Fairmont Municipal Airport (4G7)

• Logan County Airport (6L4)

• Marshall County Airport (MPG)

• Summersville Airport (SXL)

• Braxton County Airport (48I)

• Wheeling Ohio County Airport (HLG)

• Appalachian Regional Airport (EBD)

• Grant County Airport (W99)

2.2 West Virginia Air Cargo Service Classification Types

Commercial air freight in West Virginia connects to other forms of transport. The transport mode used

depends on the operator of air freight as well as the facilities available at the destination. The following

section will provide an overview of the air freight types available in West Virginia, which often have specific

time of day and routing patterns.

2.2.1 Dedicated Air Cargo

Dedicated air cargo operators deliver cargo from the origin airport to the destination airport with an aircraft

that is dedicated to cargo transportation. Dedicated cargo aircraft can require special equipment to load

cargo onto and off the aircraft. They also require a cargo ramp to operate under normal circumstances.

In West Virginia, USA Jet Airlines is one of the air freight operators that provide freight services and utilizes

one McDonnell-Douglas MD-83 aircraft and six MD-88(SF) planes, operated as full freighter aircraft.

USA Jet Airlines operates on-demand air charter freighter services in North America. It is a U.S.-based

subsidiary of Ascent Global Logistics, providing logistic services as well as technical support to freight

management. USA Jet Airlines has a relatively small fleet, with seven MD-80F planes, two Boeing 727F

planes, and one DC-9F. In 2021, USA Jet Airlines handled three tons of cargo at CRW, which accounted for

60% of air cargo tonnage at that airport.

2.2.2 Integrator

An integrator is similar to a dedicated air cargo operator in that it owns a freighter aircraft fleet. However,

integrators take full custody of a package or delivery from pick up to drop off, so they also own their own

trucks and sorting centers. FedEx, United Parcel Services (UPS), and DHL are examples of integrators

operating in the U.S.

In West Virginia, FedEx is the largest cargo integrator that provides air freight services at various airports.

FedEx Cargo Centers are set up at HTS and BKW airports to process cargo that is to be transported

onwards by truck.

FedEx is one of the largest air cargo operators in the world and the largest that operates to West Virginia. It

has nearly 700 full cargo freighter in various sizes and ranges to suit a variety of operational needs, although

the largest type to serve West Virginia on a regular basis is the Boeing 757F, which can carry more than 80

tons of cargo and is a type for which HTS is a hub airport. In 2021, FedEx processed 3,654 tons of outbound

Air Cargo Profile

West Virginia Department of Transportation

15

enplaned air freight from HTS and BKW, which accounted for approximately 98% of outbound enplaned air

freight tonnage in West Virginia.

Atlas is another major global air freighter operator, with a fleet size of 88 aircraft in 2023, although as most of

the airports with cargo operations in West Virginia have runways shorter than 7,000 feet, as well as a

relatively small air freight market, the B737F is best suited to cargo operations in West Virginia. Atlas

operated at HTS during 2021 and processed 33 tons of outbound enplaned air freight.

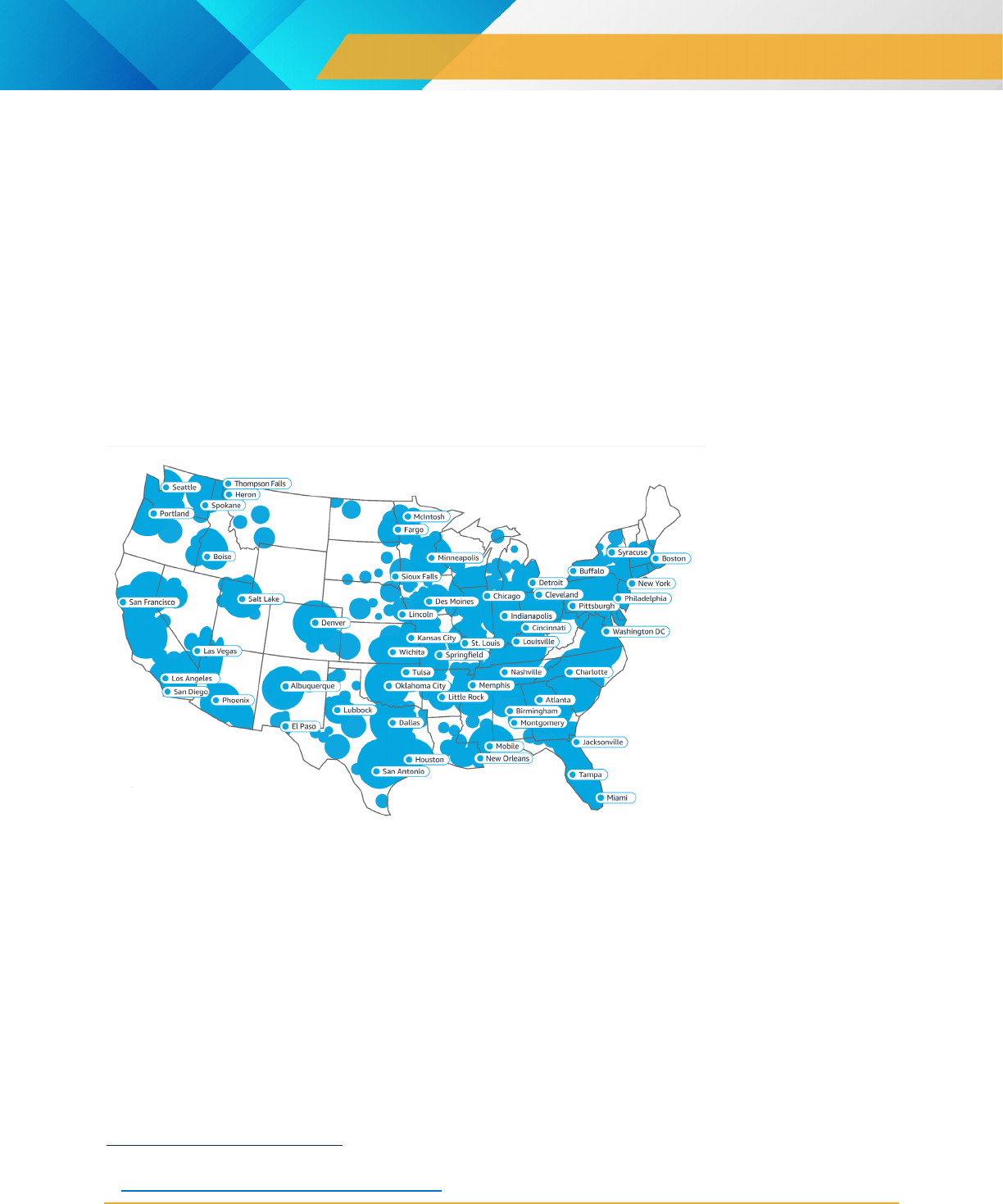

Amazon could be considered both an integrator, as it owns its own freighter aircraft fleet, and dedicated air

cargo, in that its aircraft is dedicated to cargo transportation. Amazon generates its own freight cargo via its

e-commerce platform and provides freight solutions to third party clients.

11

Amazon’s freight coverage for

third party clients includes most major U.S. cities as shown in Figure 2-7 below.

Figure 2-7 Amazon Freight Coverage Map

Source: Amazon Freight

2.2.3 Belly Cargo

Belly cargo is carried in the holds of passenger aircraft. When passenger aircraft are operated, passenger

baggage is loaded on the lower deck of the aircraft. However, this seldom utilizes all the space in the lower

deck. The typical design of passenger aircraft allows the fitting of Unit Load Devices (ULDs) into the lower

compartment to carry belly cargo as well as passenger baggage.

Other airlines that transport air freight from West Virginia use the belly cargo compartment of passenger

aircraft. United Airlines, being one of the largest passenger aircraft operators in the U.S., handled a total of

21 tons of enplaned air freight from West Virginia in 2021 and was the sole operator of air cargo at HTS and

CKB. PSA Airlines is a subsidiary of American Airlines Group (AA), owning more than 130 CRJ jet aircraft. In

11

Amazon Freight: Shipping and Logistics Services

Air Cargo Profile

West Virginia Department of Transportation

16

2021, the airline handled two tons of outbound enplaned air freight at CRW in its passenger aircraft cargo

compartment, having a 40% share of the market at CRW. Piedmont Airlines is also a subsidiary of AA,

providing U.S. regional passenger services with more than 50 ERJ-145 airplanes. It transported one ton of

air cargo in 2021 at HTS, accounting for less than 1% of the cargo tonnage at the airport. It should be noted

that the cargo capacity in these CRJ and ERJ aircraft is exceptionally small. However, AA is phasing out

these aircraft to be replaced with larger Embraer E-175 jets which have larger hold capacity. When these

aircraft are deployed on these routes, it will present an opportunity to increase the freight activity to the

respective airports.

2.2.4 U.S. Mail

The United States Postal Service (USPS) is one of the world’s largest mail delivery services; however, it

does not operate any aircraft. Instead, the USPS contracts its airmail operations out to commercial

operators, including passenger carriers (although some aircraft historically were operated in a USPS livery,

these were aircraft operated under contract).

In the fiscal year 2022, the USPS increased its spending on surface transport (trucks) to move mail and

packages between facilities and shifted volume away from air. This is part of a plan to improve the USPS’s

financial position, with Postmaster General Louis De Joy noting that trucking capacity in the ‘middle mile’

network is underutilized,

12

and is likely to impact air carriers. The USPS was FedEx’s largest customer as of

May 2022 (FedEx carried USPS mail on domestic air routes), and FedEx stated that ‘A decision by the

USPS to terminate early or not renew its contract with FedEx Express for domestic services, which expires in

September 2024, would negatively impact our profitability’.

13

2.3 Other Air Cargo Gateways

Much of the air cargo moving through WV travels via truck to and from airports outside the state, including

Washington Dulles (IAD), Baltimore (BWI), Cincinnati (CVG) and others. Carriers using these airports include

USA Jet Airlines, FedEx, UPS, Delta Air Lines, and Air Transport International.

Washington Dulles (IAD):

Washington Dulles Airport is used by USA Jet Airlines

Baltimore (BWI)

Baltimore/Washington International Airport serves about twenty freight carrier companies including FedEx,

UPS, Delta Air Lines, American Airlines, British Airways, and ABX Air Inc.

Cincinnati/Northern Kentucky International Airport (CVG)

Cincinnati/Northern Kentucky airport is used by nearly thirty different freight carrier companies, including

FedEx, UPS, United Air Lines, Delta Air Lines, Air Transport International, Atlas Air Inc, and Amazon.

12

Supply Chain Dive, ‘US Postal Service spends more on ground transport as it shifts away from air cargo’, Mar 16, 2023

13

Supply Chain Dive, ‘US Postal Service spends more on ground transport as it shifts away from air cargo’, Mar 16, 2023

Air Cargo Profile

West Virginia Department of Transportation

17

Amazon has announced the upcoming development of its primary hub on the south side of CVG’s airfield.

The hub will include $1.5 billion of investments including over a hundred Prime Air cargo planes, construction

of three million square feet of buildings, and more than 2,000 additional jobs.

14

Figure 2-8 Freight Airports near West Virginia

Source: Bureau of Transportation Statistics, 2023

14

Amazon and CVG (cvgairport.com)

Air Cargo Profile

West Virginia Department of Transportation

18

3.0 AIR CARGO DEMAND

3.1 Total Air Freight Demand

Demand for freight transportation in West Virginia is driven by the state’s economy. Traditionally, energy and

manufacturing industries have been the key drivers West Virginia’s economy (coal is still the top commodity

by weight shipped to and from West Virginia); however, technology-based businesses are playing an

increasingly significant role. This shift from high-weight, low-value goods to lower-weight, high-value goods

increases the importance of air cargo as a freight mode in the state, as these industries are more likely to

ship and receive time-sensitive goods. Other economic trends, such as the rise of e-commerce, also play a

significant role in driving the demand for air cargo in West Virginia.

This section uses FHWA's Freight Analysis Framework (FAF) data to show the projected demand for air

cargo in West Virginia. Due to the nature of FAF data, these numbers and forecasts include both volumes of

goods that are trucked to and from airports outside of West Virginia in addition to goods that move through

airports within the state. Through traffic, i.e., traffic that does not begin or end its journey in West Virginia, is

not included.

Figure 3-1 shows the share of goods tonnage moving on each mode of in West Virginia from 2017 projected

to 2050. A large share of freight tonnage is transported to and from West Virginia by truck (45% in 2019).

Trucks are expected to continue to be the dominant mode through 2050, increasing their share to 57% by

2050. Other significant modes of freight transport from West Virginia are rail, pipelines, and water. Air

(including truck-air) freight contributed about 0.01% to the overall share of freight tonnage transported to and

from the state in 2019.

15

The FAF data indicates that a little over 31,700 tons of air (including truck-air) freight

arrived or departed West Virginia in 2019, and this is expected to increase to approximately 119,200 tons by

2050. Figure 3-2 presents the historic and forecast outbound air freight tonnage from West Virginia. While

the share of air freight tonnage is expected to remain at under 1% through 2050, volumes are expected to

increase by an average of 4% per annum between 2019 and 2050.

15

Freight Analysis Framework (FAF) data, accessed via the Bureau of Transportation Statistics, April 2023

Air Cargo Profile

West Virginia Department of Transportation

19

Figure 3-1 Share of Two-Way Freight Transport Modes by Tonnage in West Virginia, 2017 Projected

through 2050

Source: Freight Analysis Framework (FAF), accessed via the Bureau of Transportation Statistics, April 2023

Figure 3-2 Two-Way Air Freight Tonnage in West Virginia, 2017 through 2050

Source: Freight Analysis Framework (FAF), accessed via the Bureau of Transportation Statistics, April 2023

Figure 3-3 shows the historic and forecast share of commodities transported to and from West Virginia by air

freight. Most of West Virginia’s air freight is expected to consist of mixed freight and plastic and rubber

exports.

Air Cargo Profile

West Virginia Department of Transportation

20

Figure 3-3 Air Freight Commodities to and from West Virginia 2017 through 2050

Source: Freight Analysis Framework (FAF), accessed via the Bureau of Transportation Statistics, April 2023

Most of the air freight (over 90% according to FAF data in 2019) arriving into West Virginia is from U.S.

domestic origins, most notably Tennessee and this may be due to FedEx having a ‘super hub’ at Memphis

International Airport. It should be noted that the volume of outbound freight far exceeds the inbound,

suggesting that West Virginia is producing commodities which are being shipped worldwide much more than

they are receiving goods and services. Most of the air freight departing from West Virginia is ultimately

travelling to international destinations and this is expected to remain the case through 2050. Most freight

from West Virginia is destined for Eastern Asia (China was the largest importer of natural rubber in 2021

16

)

and Europe. Eastern Asia is expected to be the ultimate destination for over 66% of air freight from West

Virginia from 2022 through 2050. Figure 3-4 shows the air freight arriving into and departing from West

Virginia, with the most significant increase shown to Eastern Asia.

Figure 3-4 Ultimate Origins and Destinations of Air Freight to and from West Virginia 2017

through 2050

Source: Freight Analysis Framework (FAF), accessed via the Bureau of Transportation Statistics, April 2023

16

Statistica.com

Air Cargo Profile

West Virginia Department of Transportation

21

As West Virginia’s airports handle no direct flights to overseas destinations, the air freight from West Virginia

bound for overseas destinations transits through other U.S. airports. Figure 3-5 shows that most of the air

freight to and from West Virginia travels via Tennessee and New York (over 70% in 2019).

Figure 3-5 Domestic Origins and Destinations (U.S. States) of Air Freight to and from West Virginia

2017 through 2050

Source: Freight Analysis Framework (FAF), accessed via the Bureau of Transportation Statistics, April 2023

Florida has also been one of the main domestic transiting points for air freight, although there may well be

the emergence of other domestic transiting points as airlines offer new service to West Virginia, opening up

competitive alternative routes. With respect to international air freight, it is likely that these commodities and

packages transit ‘hub’ airports located within these states:

• New York: New York’s John F Kennedy International Airport (JFK) is one of the U.S.’s major airports and

handles many intercontinental flights to countries in Eastern Asia and Europe, as well as Canada, South

America, the Caribbean, the Middle East, and Africa.

• Illinois: The busiest airport in Illinois is Chicago’s O’Hare International. O’Hare is a major North American

hub, and handles flights to Europe, Asia, Canada, South America, and the Middle East.

• Pennsylvania: Pennsylvania’s busiest airports are Philadelphia International and Pittsburgh International.

These airports do not serve the range of intercontinental destinations that JFK or O’Hare do, however

Canada, the Caribbean, Europe, and the Middle East can be reached directly from Philadelphia, while

Canada and some European destinations (notably the UK) can be reached directly from Pittsburgh.

17

3.2 Future of Aviation Trends

This section will cover aviation trends that have the potential to impact air cargo and related activities in West

Virginia. Key trends examined include aircraft and airport technology, economic trends, Unmanned Aerial

Systems (UAS), aviation security, and responses to the COVID-19 pandemic.

17

Mott MacDonald analysis of SRS Schedules Analyser data, accessed April 2023

Air Cargo Profile

West Virginia Department of Transportation

22

3.2.1 Aircraft and Airport Technology

Aviation is an ever-evolving industry, with significant technological changes over the last 20-30 years.

Passenger airlines have been streamlining their service and reducing service to smaller destinations while

also replacing regional jets serving up to 50 passengers with larger 76-100-seat aircraft. This trend towards

larger aircraft has mixed impacts on air cargo, as larger aircraft have potentially more available belly space

for cargo, however the reduced service to smaller airports means fewer potential connections.

Many passenger aircraft are also converted to freighter aircraft at the end of their passenger-carrying life.

Aircraft such as the Boeing 757 and Boeing 767, McDonnall-Douglas MD-80/90, Saab 340, Aerospatiale

ATR-42/72 and Cessna Caravans, for example, are increasingly being converted to freighters for use in

carrying goods for both air cargo and integrated carriers.

A drive towards efficiency and reduction in greenhouse gas emissions is driving increasing efficiency in

aircraft design and fuel consumption. New fuel sources for aircraft, including low-emission diesel, hydrogen,

and electric-batteries, and being rolled out at an acerated rate. As severe weather and climate change

continue to impact our infrastructure, resiliency and energy efficiency are of growing importance to airport

infrastructure, from runways to cargo buildings. Airport buildings, including cargo-handling facilities, are also

opportunities for human-focused improvements, such as lighting, ventilation, water-use, aesthetics, waste

disposal, and other factors which can improve working conditions as well as building efficiency. Finnair’s new

COOL Nordic Cargo Hub at Helsinki airport includes solar panels providing 10% of the terminal’s energy, an

automated storage area with no lighting requirements, and automation and processes that reduce transport

time, vehicle idling, and waste management and maintenance trips.

18

3.2.2 Economic Trends

As cited in the 2020 West Virginia Aviation Economic Impact Study,

19

the existing aerospace industry in the

state supports 4,000 jobs, $201 million in payroll, and has a total economic impact of $1.325 billion as of

2019. By leveraging its aviation focused industries and those that use air cargo, West Virginia can continue

to grow and diversify its economy. Companies already operating within West Virginia include Pratt and

Whitney Engine Services and Helicopter Powerline Services. Aviation-focused and air cargo industries can

18

What does green air cargo terminal design look like? (finnair.com)

19

WV AEIS Complete Technical Report_.pdf

Air Cargo Profile

West Virginia Department of Transportation

23

provide an attractor for both vertical and horizontal supply chains, which facilitates the state’s efforts to

attract other industries.

Worldwide, e-commerce has been one of the driving forces of a shifting economy over the last decade. The

effects of e-commerce were multiplied during the COVID-19 pandemic when electronic purchasing of goods

and services grew at an accelerated pace and replaced traditional commercial activities for both businesses

and consumers. Amazon and other suppliers have expanded exponentially, setting up warehouses and

distribution centers across the globe and country. Amazon Air, a cargo airline exclusively devoted to Amazon

fulfillment, launched in 2015 and offers direct service to many airports.

20

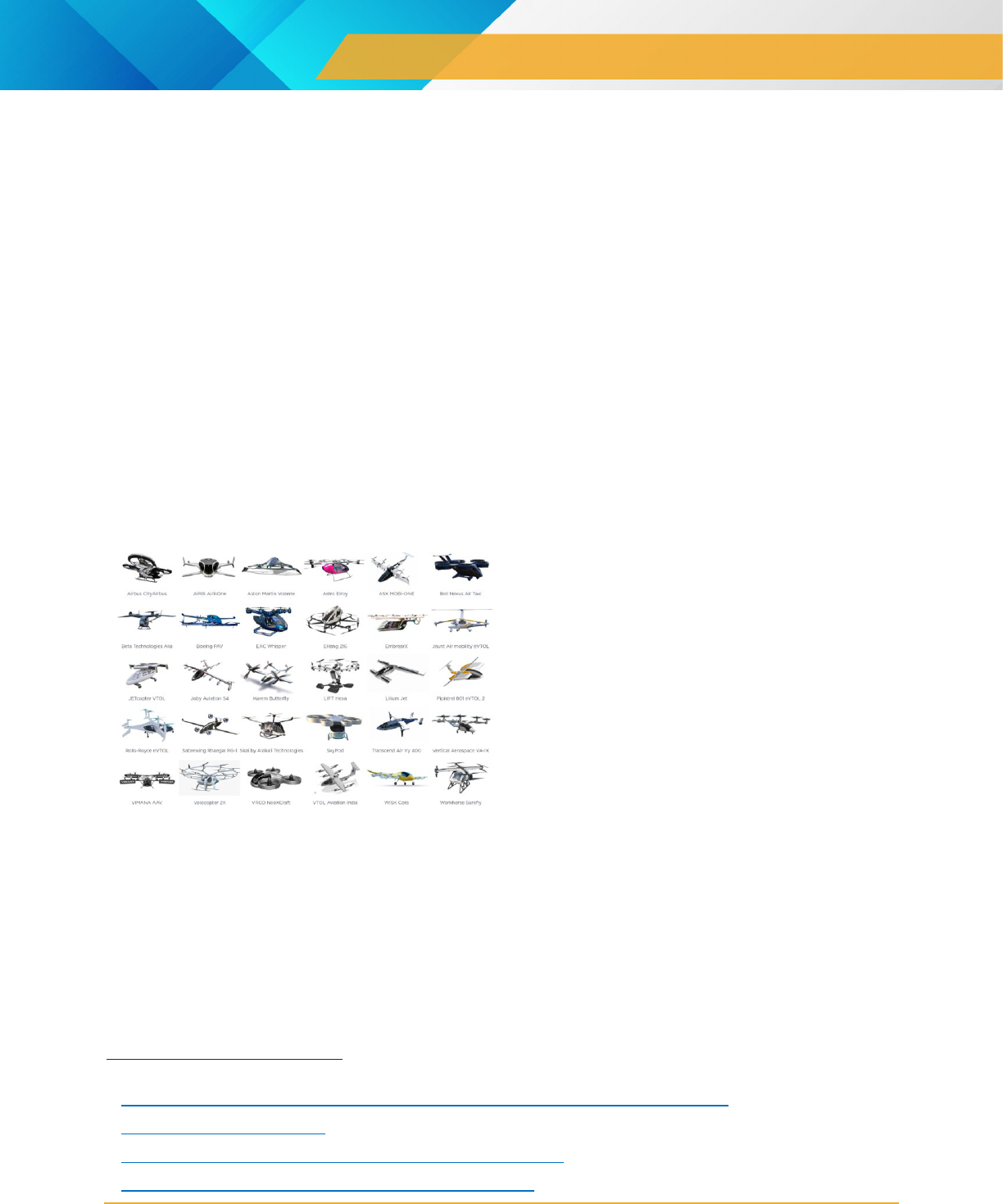

3.2.3 Advanced Air Mobility, Urban Air Mobility, and Unmanned Aircraft Systems

Advanced Air Mobility (AAM) is the integration of highly automated aircraft into the National Airspace

System.

21

Urban Air Mobility (UAM) is one concept of this, referring to the movement of passengers or cargo

via highly automated aircraft within urban areas.

22

Both concepts are managed by the FAA and are under

exploration and development.

Some operators are anticipating that AAM and UAM operations for cargo could commence as early as 2024,

with passenger vehicles to be developed in parallel, but operations likely to start sometime after 2026.

23

The initial stage length anticipated for these

operations would be up to 200 miles at most, with

small loads. These vehicles will be able to serve

remote communities much faster than existing

modes of transport. Some of the lighter and smaller

freight may switch to this mode, resulting in a

potential shift in the modal split for freight, particularly

as the speed at which this mode can operate may

well be faster than by truck or rail.

Unmanned Aircraft Systems (UAS) refers to varying

types of drone aircraft. UAS may also be a tool

employed in the future within cargo warehouses to pick goods, identify lost cargo and/or perform other

functions. Both processes and infrastructure may change over coming years to respond to increased robotics

and automation throughout the cargo handling supply chain.

3.2.4 Aviation Safety and Security

The FAA is the primary agency responsible for all aspects of aviation safety, and regulates both passenger

and air cargo traffic, as well as airports. Generally, air cargo is a safe mode of transportation, as is the entire

20

Amazon in talks to lease Boeing jets to launch its own air-cargo business | The Seattle Times

21

Advanced Air Mobility (faa.gov)

22

Urban Air Mobility (UAM) Concept of Operations 2.0_0.pdf (faa.gov)

23

HAI_Advanced_Air_Mobility_Report_04-07-2023.pdf (rotor.org)

Air Cargo Profile

West Virginia Department of Transportation

24

aviation industry.

24

The International Civil Aviation Organization (ICAO) tracks global aviation safety and

reported a 9.8% decrease from 2.14 accidents per million departures in 2020 to 1.93 accidents per million

departures in 2021.

25

Of growing concern in recent years is the increase in cargo theft across the transportation supply chain. The

supply chain that air cargo incurs from origin to destination is subject to numerous risks including staffing

shortages and cargo theft.

26

Regulators and industry are working together to further secure the supply chain

while protecting the shipment and transfer of goods and services in support of global and local economies.

3.2.5 Response to the COVID-19 Pandemic

The aviation industry was significantly impacted by the COVID-19 pandemic. While passenger and some

cargo demand waned precipitously, other markets grew quickly. The aviation industry was tapped to respond

to growing demand for food, supplies, and manufacturing components, many of which would have previously

traveled by ship, rail, or truck, but due to the time and market constraints, became a market for air cargo.

Existing fleets were adapted to accommodate huge increases in demand, while the demand in some markets

faded as the crisis became less acute, others remained for the long haul.

24

Cargo Safety | Federal Aviation Administration (faa.gov)

25

ICAO_SR_2022.pdf

26

From the Magazine | Mitigating Supply Chain Risks In 2023 - Logistics Insider

Air Cargo Profile

West Virginia Department of Transportation

25

4.0 CONDITION AND PERFORMANCE

Airport condition and performance are largely dependent on their roadway connectivity and operating

capacity.

27

The following sections review the roadway networks surrounding West Virginia’s main freight

airports and future trends for the capacity of each airport.

4.1 Road Network Access

Road network around the airports is essential to efficient operation, especially for freight operations and truck

access. The WVDOT Aeronautics Commission works directly with airports and the FAA for projects funded

through Airport Improvement Program (AIP) funds for 'inside the gate' improvements, including roadway

intra-airport improvements.

28

WVDOT is also concerned about access into and out of airports, working to

provide truck access via roadways of appropriate condition and capacity.

4.1.1 BKW

BKW is 1.5 mile away from the entrance of I-64 highway connected by a single lane two-way minor road,

further connected to U.S. 19 to the north and I-64 and I-77 to northwest and southeast. There is a small

settlement and an academy near the entrance of the I-64 highway which might cause minor congestion.

27

Texas Transportation Institute Guidebook on Landside Freight Access to Airports, February 2011.

http://tti.tamu.edu/documents/0-6265-P1.pdf

28

2022 Airport Improvement Program (AIP) Grants | Federal Aviation Administration (faa.gov)

Air Cargo Profile

West Virginia Department of Transportation

26

Figure 4-1 BKW Airport

Source: OpenStreetMap

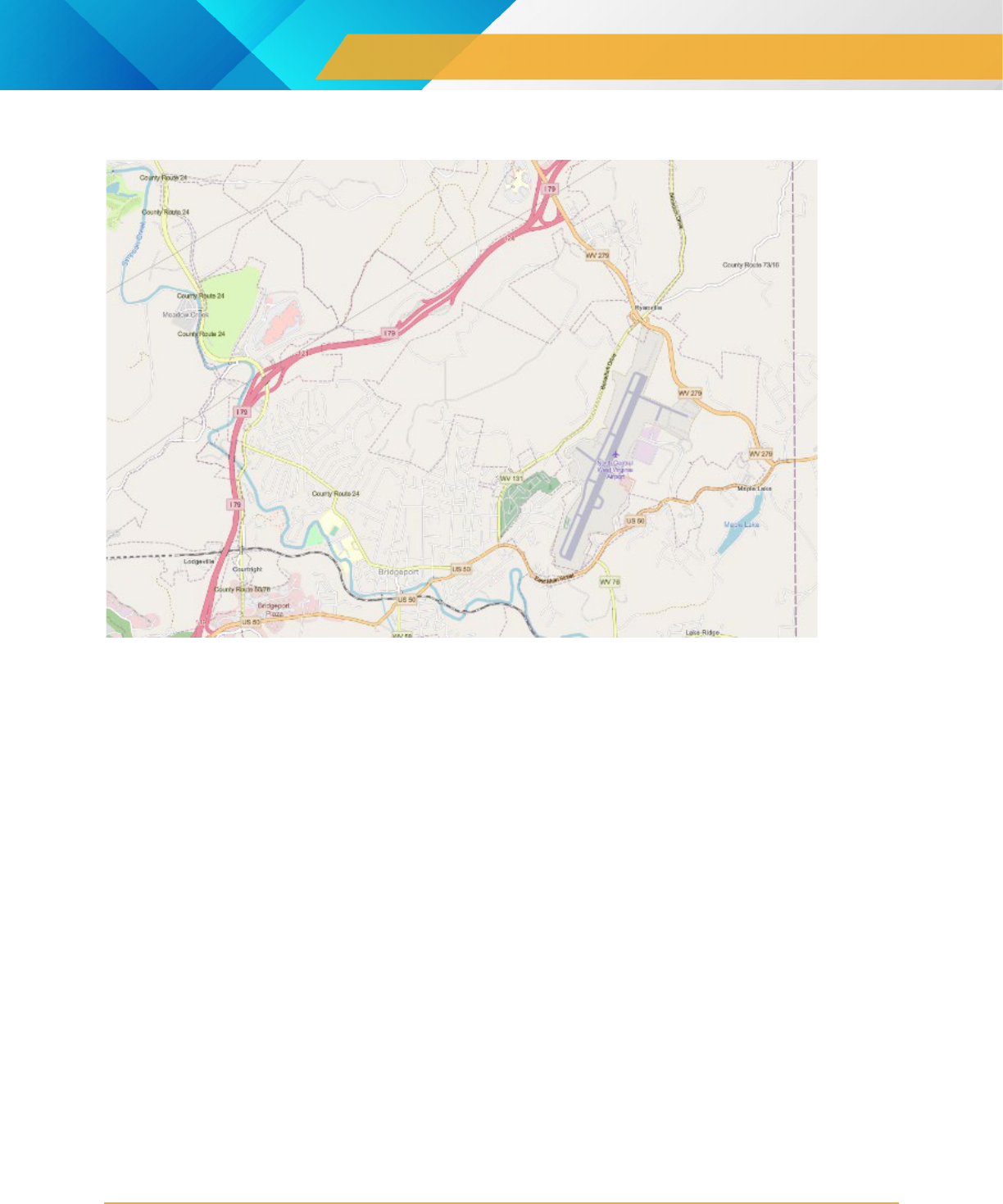

4.1.2 CKB

CKB is directly next to the U.S. 50 and connects to I-79, which makes the airport accessible. However, the

airport is surrounded by a large number of settlements that are also connected to U.S. 50, which may lead to

congestion before the truck can get onto I-79 highway that is isolated with local traffic.

Air Cargo Profile

West Virginia Department of Transportation

27

Figure 4-2 CKB Airport

Source: OpenStreetMap

4.1.3 LWB

LWB is easily accessible from U.S. 219 highway with the airport major access road directly connected to it in

less than 0.5-mile distance. The U.S. 219 highway is then connected to I-64 and U.S. 60 in the south. There

are a few settlements on U.S. 219 before reaching the junction to I-64, which may cause minor traffic

congestion to the area and delay ground access to the airport.

Air Cargo Profile

West Virginia Department of Transportation

28

Figure 4-3 LWB Airport

Source: OpenStreetMap

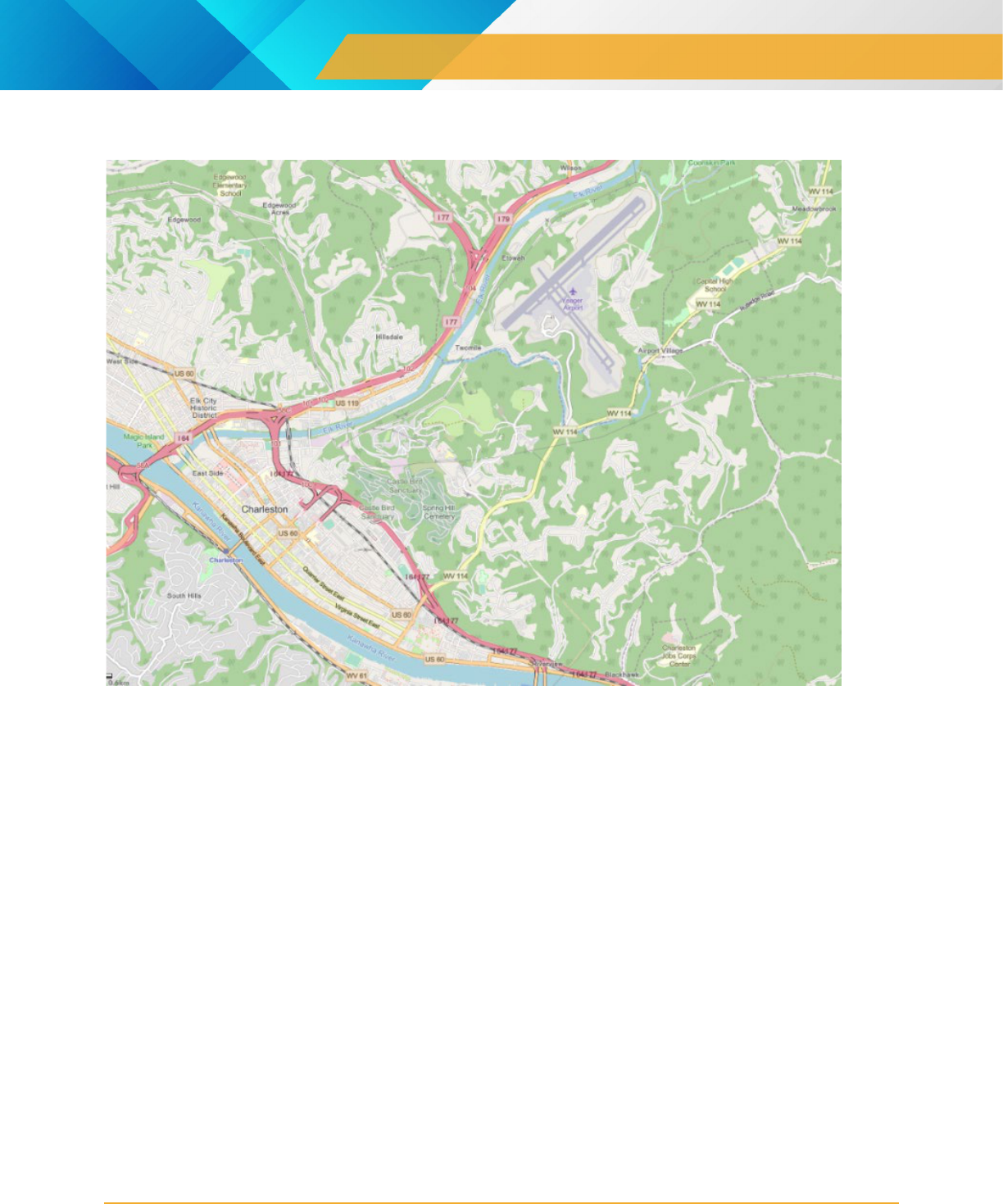

4.1.4 CRW

CRW is relatively less accessible by ground transport as it is only connected WV-114. It is separated from

I-77 and I-79 by Elk River, with no bridge connections across the river. All ground transport freight

connection relies on WV-114, which connects to I-64 and I-77 three miles southwest of the airport. This

creates a bottleneck along WV-114, which is subject to disruption by local Charleston traffic.

Air Cargo Profile

West Virginia Department of Transportation

29

Figure 4-4 CRW Airport

Source: OpenStreetMap

4.1.5 HTS

At HTS, the airport is connected with a two-mile-long single lane two-way road that is then connected to

U.S. 52, U.S. 23 and I-64. Truck access to the airport is efficient, as the airport is directly connected to the

highway without passing through industrial or residential neighborhoods. However, if truck traffic increases,

WVDOT should continue to monitor the condition and safety of the infrastructure, including lanes and

shoulders.

Air Cargo Profile

West Virginia Department of Transportation

30

Figure 4-5 HKS Airport

Source: OpenStreetMap

4.2 Capacity

West Virginia airports typically have enough capacity on the airfield, runways, and ramps to handle current

and future air cargo demand. As air cargo demand grows, terminals, processing facilities and roadway

infrastructure will be the first constraints to growth in air cargo services at West Virginia airports.

WVDOT will remain in contact with the airport operations and handlers locally to establish whether additional

processing facilities or landside/airport-specific warehouses are required to accommodate growth in demand

and whether land has been safeguarded for said growth.

4.3 Conclusions

As discussed, the aviation industry provides essential links to both rural communities within the state as well

as international access to send and receive goods and services globally. It is imperative for the economic

success of the state to maintain these services.

WVDOT should regularly communicate (monthly or quarterly) with the local agencies and airports to have an

up to date understanding of the movement of air freight, and how this is changing/evolving over time. There

may be some significant trigger points which the local agencies will identify and be able to share with

WVDOT to support the development of air freight. In addition, WVDOT should focus on maintaining a full

understanding of the industries most likely to rely on air to transport their cargo, such as health care

(biomedical goods), retail trade, natural resource extraction, transportation and warehousing, and

Air Cargo Profile

West Virginia Department of Transportation

31

construction. By identifying and understanding these industries, WVDOT will maintain an ability to assess

and predict their impacts on the West Virginia infrastructure and economy as a whole.

Finally, West Virginia is in close proximity to major air cargo centers including Columbus OH, Charlotte NC,

and Dulles VA. Ensuring efficient roadway access to these facilities is critical for meeting freight demands

and supporting the local economy.