Benefits offered to State of Wisconsin employees is a valuable part of an individual’s compensation package. The benefits summary below may

vary somewhat between employee groups based on percentage of full-time employment, and “exempt” or “non-exempt” status under the Federal

Labor Standards Act. This 2024 summary relates to permanent classified and unclassified employees.

TABLE OF CONTENTS

ANNUAL PAID LEAVE ........................................................................................................................ 1

HEALTH INSURANCE ........................................................................................................................ 2

WELLNESS ........................................................................................................................................ 4

DENTAL INSURANCE ........................................................................................................................ 5

VISION INSURANCE .......................................................................................................................... 6

PRE-TAX SAVINGS ACCOUNTS / FLEXIBLE SPENDING ACCOUNTS (FSA) .................................... 6

ACCIDENT PLAN ............................................................................................................................... 7

INCOME CONTINUATION INSURANCE ............................................................................................. 7

LIFE INSURANCE .............................................................................................................................. 8

WISCONSIN RETIRMENT SYSTEM (WRS) ........................................................................................ 9

WISCONSIN DEFERRED COMPENSATION (WDC) ......................................................................... 10

EDVEST ........................................................................................................................................... 10

Every effort has been made to ensure the information in this benefit summary is true and accurate. If there is any discrepancy between this summary and the

official plan documents, the language in the official documents shall be considered accurate. To enroll and participate in the benefit plans outlined in this

document, you must meet all eligibility requirements as defined by the Wisconsin Retirement System and Wisconsin State Statutes.

Department of Health Services

2024 Employee Benefit Summary

P-02873 (04/2024)

Return to Table of Contents Page 1 of 10

ANNUAL PAID LEAVE

Leave Benefits for Permanent Employees* are summarized below for full-time employees. Amounts are adjusted based on date of hire for new

employees or transfer.

Note: All leave types are prorated for employees who work less than 100%. (*Not applicable to Craftworker and Weekend Nurses / Weekend

RCTs).

Vacation, personal holiday, legal holiday hours are granted on January 1st of each year, or upon hire date.

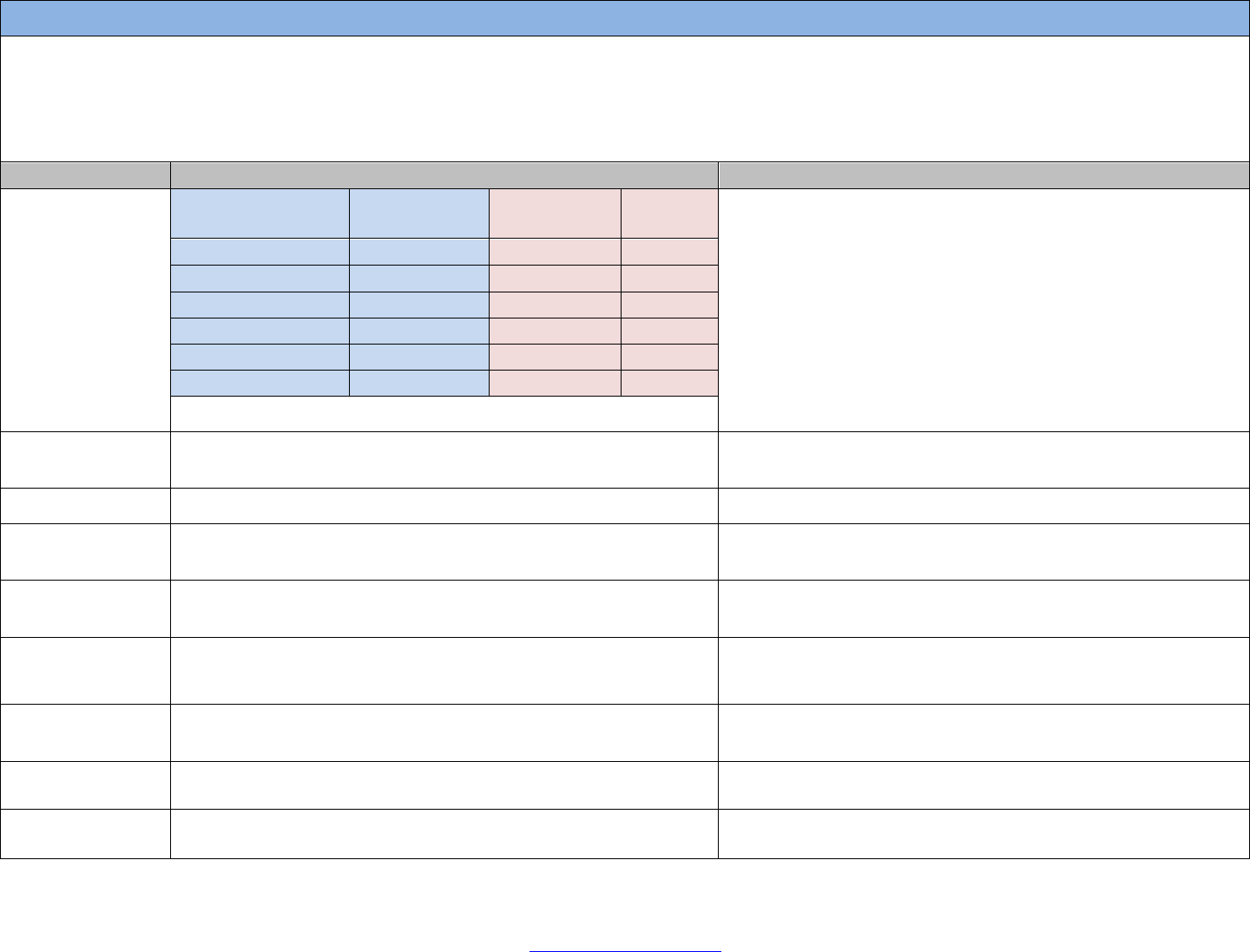

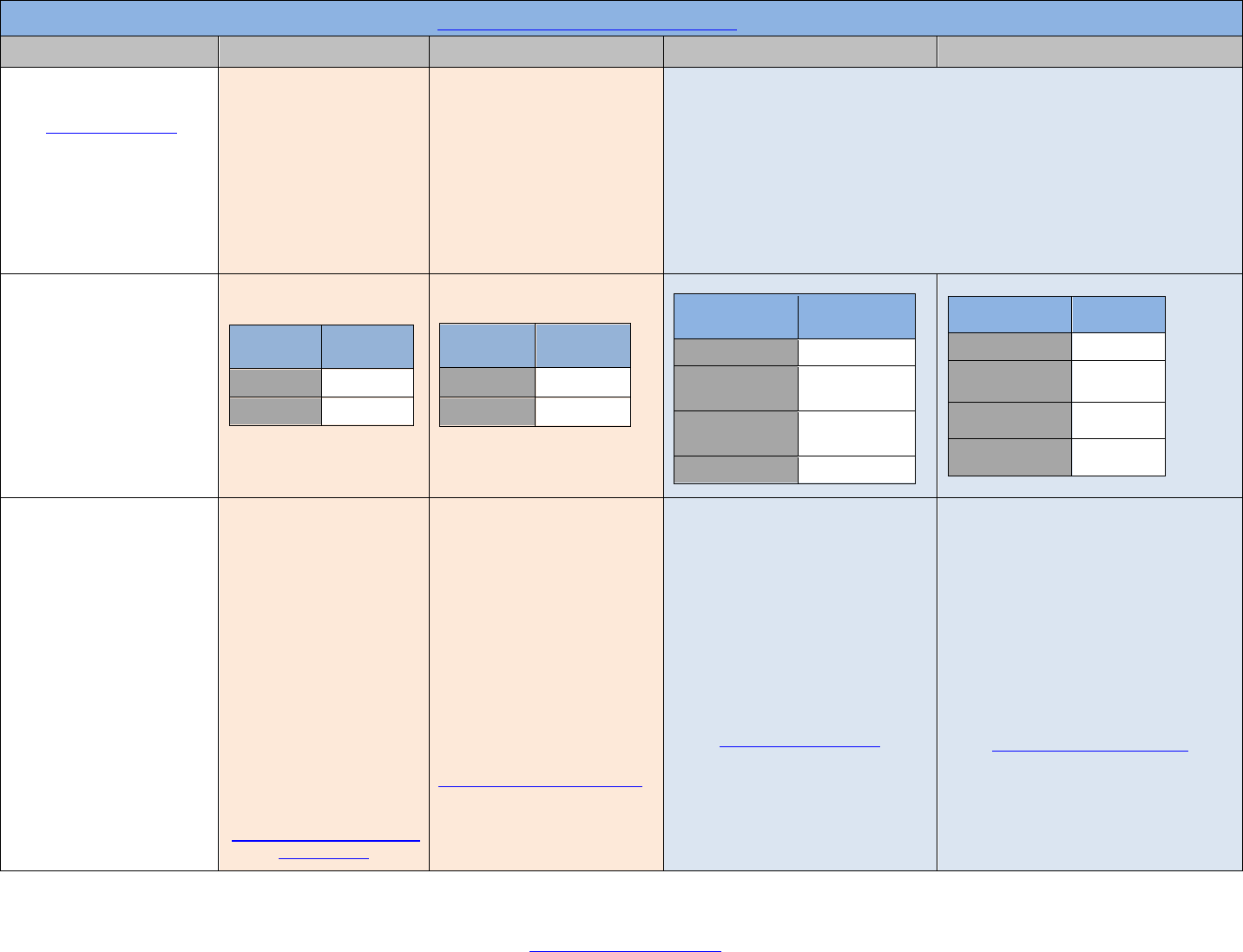

Type of Leave

Hours Earned for full-time employee

Carryover/Expiration

Vacation

Yrs. Of Service

FLSA

Non-exempt

Yrs. Of

Service

FLSA

Exempt

For new employees (without prior service), all hours earned

in a calendar year may carryover to June 30

th

* of the next

calendar year. Hours are lost if not used or banked (if

eligible) by end of the carryover period.

*

Vacation is earned from the first day of employment, but cannot

be used until the employee has completed their first six months of

classified employment.

0 - 5 Yrs

104

0 - 5 Yrs

120

5+ - 10 Yrs

144

5+ - 10 Yrs

160

10+ - 15 Yrs

160

10+ - 15 Yrs

176

15+ - 20 Yrs

184

15+ - 20 Yrs

200

20+ - 25 Yrs

200

20+ - 25 Yrs

216

25+ Yrs

216

25+ Yrs

216

Vacation accrual are adjusted with use of leave without pay.

Personal Holiday

36 hours (4.5 days) per year

Hours must be used in the calendar year granted or they are

lost

Sick Leave

5 hours per paycheck, 130 hours (16.25 days) per year

Hours accumulate without limit from year to year

Bereavement

Leave

Sick leave may be used upon the death of an immediate

family member.

See Sick Leave above

Legal Holiday

72 hours (9 days) per year

Hours must be used in the calendar year granted or they are

lost

Military Leave

Up to 30 paid leave days per calendar year for duty or training

lasting 3 days or more

Hours will be granted upon qualified

request per calendar year

Jury/Witness

Leave

Paid leave when summoned as a witness for the employer or

impaneled as a jurist

Hours will be granted upon qualified request

Bone Marrow

Donor

Up to 5 work days Hours will be granted upon qualified request

Human Organ

Donor

Up to 30 work days Hours will be granted upon qualified request

Return to Table of Contents Page 2 of 10

HEALTH INSURANCE

Who is Eligible and When Benefits You Receive Employee Pays State Pays

All employees covered by the Wisconsin

Retirement System (WRS) are eligible for

all health insurance plans.

Must apply within 30 days of hire date

Employees have the option of starting

coverage 1

st

of month on/after initial WRS

eligibility or when the employer

contribution begins (after completion of two

months of service).

Opt out Stipend

– if you do not wish to

enroll in health insurance, you may be

eligible to receive an Opt-Out Stipend of

up to $2,000 per year (after completion of

two months of service).

In-network uniform preventative and

medical benefits are offered in all plans.

Employees can choose a health plan with

or without dental (routine and preventative

dental), and the It’s Your Choice Health

Plan or the It’s Your Choice High

Deductible Health Plan.

Single or family coverage is available.

See page 2 for highlights of the two major

plan design options of our health plan – It’s

Your Choice and It’s Your Choice High

Deductible. The main differences are

deductibles, copays, and premiums.

For all plans, the employee

has the option to start their

coverage immediately and

pay the total premium until

employer contribution begins.

Or the employee can wait to

start coverage when the

employer contribution starts.

For all plans, the

employer contribution

will begin 1

st

of the

month after two full

months of State WRS

service from the

employee’s hire date.

Health Insurance Premiums

The state pays a portion of the premium

starting first of the month following two full

months of State WRS service.

Employee Premium (with state share after

two full months of service):

Total Monthly Premium (no state share)

Note: The IYC Access plan offers

statewide/nationwide access.

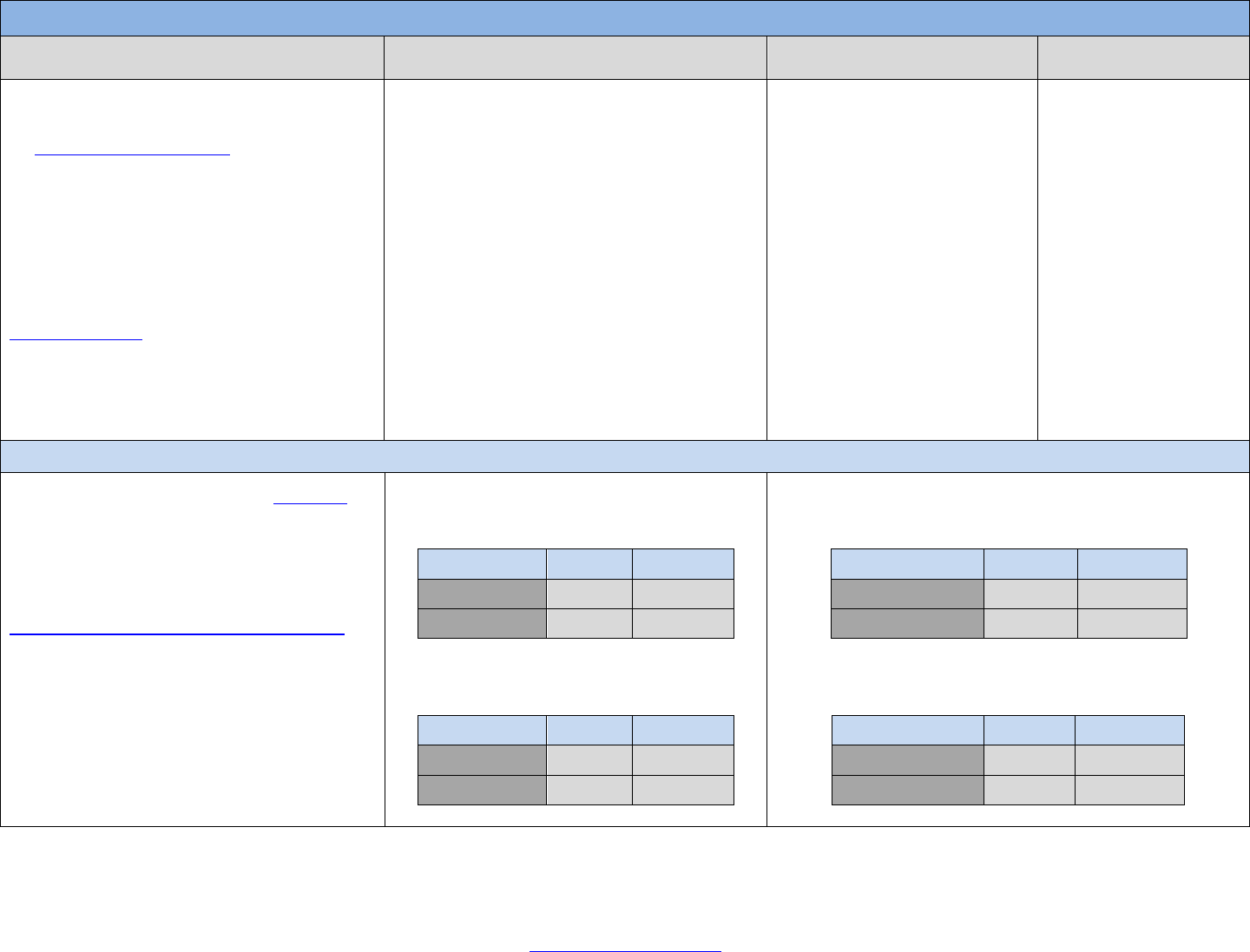

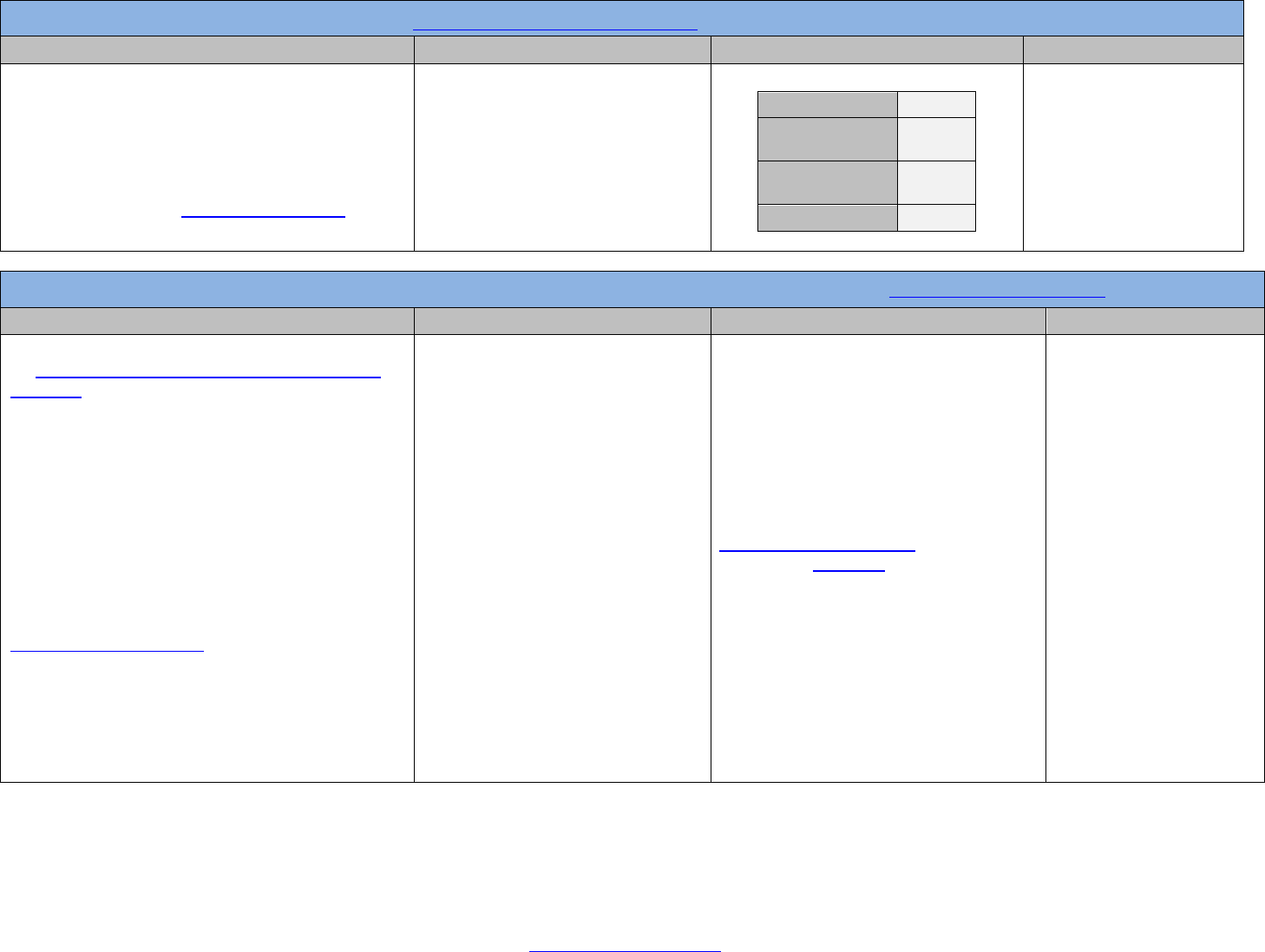

2024 It’s Your Choice (IYC) Health Plan

WITH DENTAL

Employee Monthly Premiums

Single

Family

IYC Plan $115 $286

IYC Access

$270

$673

2024 It’s Your Choice Health Plan

WITHOUT DENTAL

Employee Monthly Premiums

Single

Family

IYC Plan $112 $276

IYC Access $267 $663

2024 High Deductible Health Plan

WITH DENTAL

Employee Monthly Premiums

Single

Family

HDHP Plan $42 $107

HDHP Access

$197

$494

2024 High Deductible Health Plan

WITHOUT DENTAL

Employee Monthly Premiums

Single

Family

HDHP Plan $39 $97

HDHP Access $194 $484

Return to Table of Contents Page 3 of 10

Medical Coverages/Costs per Health Plan

(Table represents how much you may pay for common services received in-network)

IYC Health Plan Access Plan High Deductible HP Access High Deductible Health Plan

Annual Medical Deductible

Individual/Family

$250/$500

Office visit copays, preventive services and

prescription drugs do not count towards your

deductible

$1,600/$3,200

Families: Must meet full family deductible

Annual Medical Deductible Out-of-

Pocket Limit (OOPL)

Individual/Family

$1,250/$2,500

$2,500/$5,000

Families: Must meet full family OOPL before your plan pays 100%

Medical Coinsurance

100% until deductible met

After deductible: 10%

100% until deductible met

After deductible: 10%

Preventative Services

$0

Plan pays 100%

$0

Plan pays 100%

Telemedicine Services

Varies by service type

Varies by service type

Primary Care Office Visit

$15 copay

Does not count toward deductible/Counts

toward OOPL

100% until deductible met

After deductible: $15

Specialty Provider Office Visit

(Including an eye exam in an office

setting)

$25 copay

Does not count toward deductible/Counts

toward OOPL

100% until deductible met

After deductible: $25

Urgent Care

$25 copay

Does not count toward deductible/Counts

toward OOPL

100% until deductible met

After deductible: $25

Emergency Room

$75 copay

Deductible and coinsurance applies to

services beyond the copay

100% until deductible met

After deductible: $75 copay,

coinsurance applies to services beyond the copay

Health Savings Account (HSA)

Eligibility and Enrollment

(Not eligible)

HSA Enrollment required: the employer will contribute biweekly to a HSA,

when the Employer share begins for Health. The yearly amount is

prorated based on employment begin date. Annual Full-time State

contributes is: $750 single / $1,500 family. Must meet eligibility

requirements.

2024 Uniform Benefits Certificate of Coverage

Return to Table of Contents Page 4 of 10

Pharmacy Benefits – Navitus Prescription Plan included in all health plan options

(Required to use in-network pharmacy. Visit https://etf.benefits.navitus.com/en-US/Pages/Nav/Home.aspx) 2024 Uniform Pharmacy Benefits Certificate of Coverage

IYC Health Plan

Access Plan

High Deductible HP

Access High Deductible Health Plan

Prescription Deductible

(Individual/Family)

None

Combined medical & pharmacy

$1,600/$3,200

You pay 100% of most pharmacy costs until deductible is met

1

Prescription Copay/Coinsurance

Level 1 $5 or less After deductible; $5 or less

Level 2 20% ($50 max) After deductible; 20% ($50 max)

Level 3 40% ($150 max)

2

After deductible; 40% ($150 max)

2

Level 4 $50 copay

3

After deductible; $50 copay

3

Preventative (As federally required) $0 – Plan pays 100% $0 – Plan pays 100%

Prescription Out-Of-Pocket Limit

Level 1 & 2 (Individual/Family) $600/$1,200

Combined medical & pharmacy;

$2,500/$5,000

Level 3 & 4 (Individual/Family) $8,700/$17,400

1

Before you meet your deductible, preventive drugs are covered 100% and certain maintenance medications only require a copayment or coinsurance.

2

For Level 3 “Dispense as Written” or DAW-1” drugs, your doctor must submit a one-time FSA MedWatch form to Navitus

3

Must fill at Lumicera Health Services specialty pharmacy or UW Health Specialty Pharmacies

Mail Order Pharmacy Service:

https://serve-you-rx.com/navitus/)

•

Get a 3-month supply for only 2 copays.

• Easy refills Order refills online or sign up for EZAutoFill.

•

Pharmacist support Have a question about your medication? Pharmacists are available 24/7.

•

Secure, free, and fast delivery Packaging is safe and respects your privacy. Delivery is free and fast. For more information, visit serve-you-rx.com/navitus or

call 1-800-481-3340.

WELLNESS

State of Wisconsin employees enrolled in the State Group Health Insurance and their covered spouse, can each earn a $150 Wellness Incentive. The Wellness

Incentive program is powered by WebMD One. There are three requirements to complete to earn the incentive, Health Check, Health Assessment and well-

being activity.

The Wellness Incentive is a taxable benefit that can be paid by a Visa prepaid card. https://webmdhealth.com/wellwisconsin/

Return to Table of Contents Page 5 of 10

DENTAL INSURANCE

– Delta Dental

(https://www4.deltadentalwi.com/state-of-wi/)

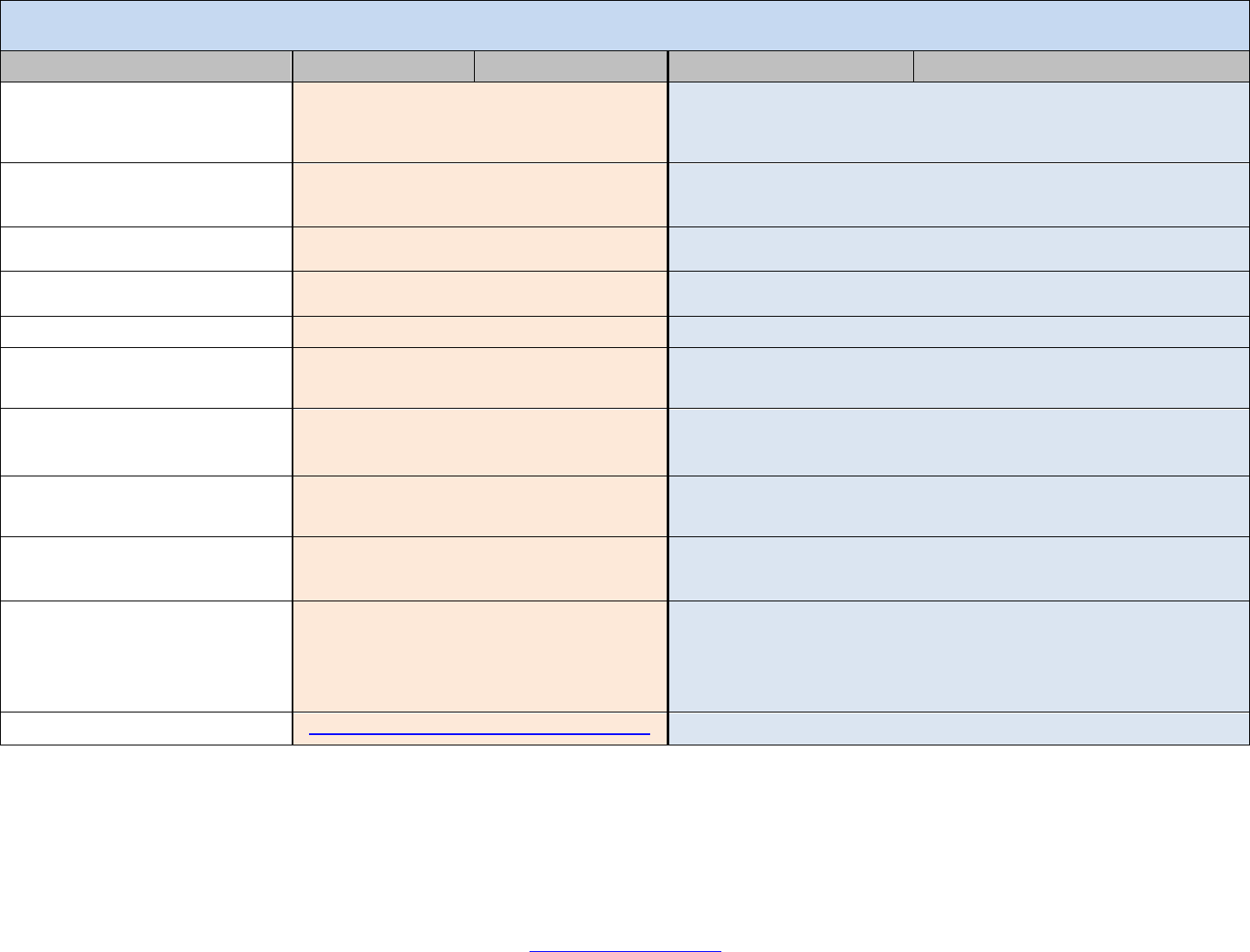

Plan Options Uniform Dental Preventative Plan Select Plan Select Plus Plan

Who is Eligible, When

and Details

See Dental Insurance

ETF website

Available to those

enrolled in health

insurance through the

State.

Basic coverage can be

added to insurance

plans for a small

increase in premium

Available to employees

NOT enrolled in group

health insurance through

the State.

Must apply within 30 days

of hire. Coverage begins on

the first of the month

on/after hire date.

All employees who are covered by WRS are eligible.

Must apply within 30 days of hire. Coverage begins on the first of the

month on/after hire date.

Once enrolled, must remain covered until the end of the calendar year.

This dental coverage is in addition to and separate from any uniform

dental benefit provided with the health insurance or the preventive plan.

Must have preventative dental care in another plan such as the State’s

Uniform Dental Benefits in the Health Plans

State does not contribute to these plans.

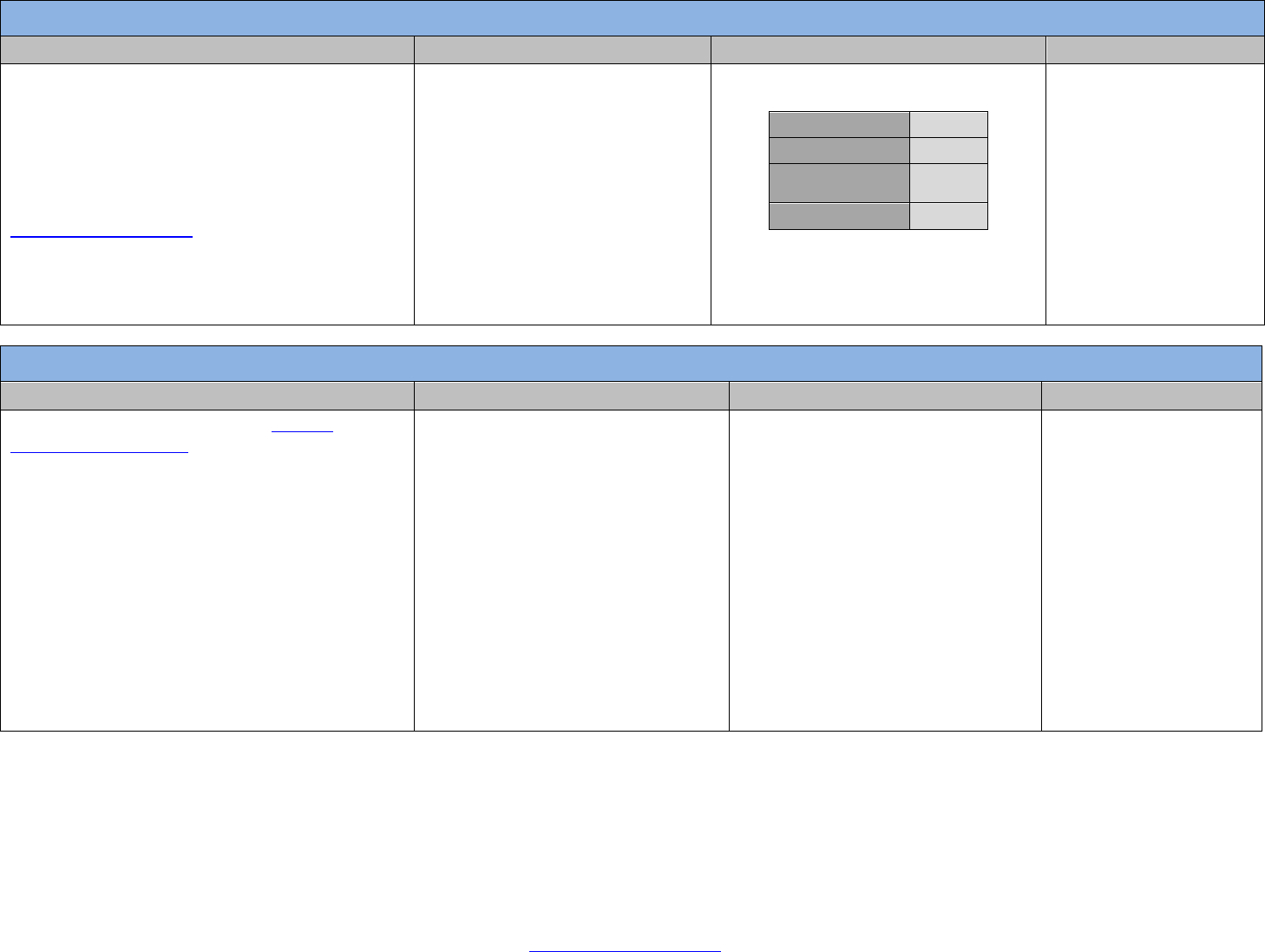

2024 Dental Premiums

See premium above within

the health insurance

Level of

Coverage

Cost per

Month

Employee $3

Family $10

Level of

Coverage

Cost per

Month

Employee $36.10

Family $90.28

Level of

Coverage

Cost per

Month

Employee $9.08

Employee +

Child(ren)

$12.24

Employee +

Spouse

$18.06

Family

$21.76

Level of

Coverage

Cost per

Month

Employee $21.60

Employee +

Child(ren)

$40.12

Employee +

Spouse

$43.22

Family $66.20

Coverage Summary

Subject to Plan

Provisions/Deductible/Co-

insurance:

• Routine evaluations,

cleaning, sealants, x-

rays, fluoride

treatments

• Fillings

• Anesthesia

• Non-surgical

extractions

• Emergency Pain relief

• Periodontal

Maintenance

• Orthodontics (under

age 19)

(Uniform Dental Certificate

of Coverage)

Subject to Plan

Provisions/Deductible/Co-

insurance:

• Routine evaluations,

cleaning, sealants, x-rays,

fluoride treatments

• Fillings

• Anesthesia

• Non-surgical extractions

• Emergency Pain relief

• Periodontal Maintenance

• Orthodontics (under age

19)

(Preventative Plan Summary)

Subject to Plan

Provisions/Deductible/Co-insurance:

• Crowns, bridges, dentures,

implants

• Surgical extraction

• Root canal

• Endodontics

• Periodontics (except

maintenance)

• Oral surgery (PPO Dentists

only)

(Select Plan Summary)

Subject to Plan

Provisions/Deductible/Co-insurance:

• Crowns, bridges, dentures, implants

• Surgical extraction

• Root canal

• Endodontics

• Periodontics (except maintenance)

• Oral surgery (PPO Dentists only)

• Orthodontia coverage for those of

any age at 50% up to $1,500 lifetime

maximum.

(Select Plus Plan Summary)

Return to Table of Contents Page 6 of 10

VISION INSURANCE

– DeltaVision

(www.deltadentalwi.com/state-of-wi-vision)

Who is Eligible and When

Benefits You Receive

Employee Pays

State Pays

All employees who are covered by WRS are

eligible.

Must apply within 30 days of hire. Coverage

begins on the first of the month on/after hire date.

Once enrolled, must remain covered until the end

of the calendar year.

For more information: DeltaVision Overview

The plan provides partial payment

to help offset the costs of annual

eye exams, frames, lenses and

contact lenses. Benefits are greater

if a DeltaVision provider is used.

100% of 2024 premium

Employee

$5.72

Employee +

Spouse

$11.42

Employee +

Child(ren)

$12.88

Family

$20.58

0%

PRE-TAX SAVINGS ACCOUNTS / FLEXIBLE SPENDING ACCOUNTS (FSA)

(http://myoptumfinancial.com/etf)

Who is Eligible and When

Benefits You Receive

Employee Pays

State Pays

All permanent and project employees are eligible

for Pre-tax Savings Accounts/Flexible Spending

Accounts. New employees must enroll within 30

days of employment.

Coverage begins on the first of the month on/after

hire date.

Employees must complete a new enrollment

during Its Your Choice Open Enrollment for the

next calendar year.

State Group Health Insurance, Delta Vision, Delta

Dental Supplemental premiums and Monona

Terrace Parking are automatically taken pre-tax

unless this option is waived or, for the optional

plans, you are covering a non-tax dependent.

Optum Financial Website

Flexible Spending Account (FSA)

plan that allows you to set up an

account for eligible medical,

dependent care, parking and transit

expenses. Deductions taken before

tax.

Health Care FSA: used to pay for

eligible medical, dental, vision and

prescription expenses that are an

out of pocket expense to the

employee.

Dependent Care FSA: used to pay

for dependent care expenses.

LPFSA (Limited Purpose Flex

Spending Account): Available with

HDHP only. Eligible expenses for

vision, dental, post-deductible

expenses, and dependent care.

Parking / Transit: Eligible expenses

are work-related transportation feed

for parking or transit.

Employees must complete a new

enrollment during Its Your Choice Open

Enrollment for the next calendar year.

Annual contribution maximums:

Health Care FSA/LPFSA: $3,050;

Carryover to new year limited to $610

Dependent Care FSA: $5,000

(restrictions may apply) Any unused

Dependent Care Account

funds at the

close of the plan year will be forfeited.

Program administrative

cost

Return to Table of Contents Page 7 of 10

ACCIDENT PLAN

– Securian

Who is Eligible and When

Benefits You Receive

Employee Pays

State Pays

All employees who are covered by WRS are

eligible.

Must apply within 30 days of hire. Coverage is

effective the first of the month following the hire

date unless the hire date is the first of the month.

Once enrolled, must remain covered until the end

of the calendar year.

Accident Plan Overview

Provides lump sum cash payment

directly to participants to cover the

unexpected, such as concussion,

burns, dislocation, fracture,

emergency care, hospitalization,

loss of a limb, surgery, accidental

death and dismemberment.

Can offset out of pocket costs for

HDHP enrollees

Dependents eligible for same

benefit amounts as employee

except for AD&D

100% of 2024 premium

Employee

$3.72

Employee + Spouse

$5.32

Employee +

Child(ren)

$7.17

Family

$10.47

0%

INCOME CONTINUATION INSURANCE

– The Hartford

Who is Eligible and When

Benefits You Receive

Employee Pays

State Pays

Employees are initially eligible for Income

Continuation Insurance coverage after 30 days of

WRS participation at any WRS employer. Must

apply in the first 30 days of employment if a

new hire. Coverage is effective the first of the

month following the hire date unless the hire date

is the first of the month.

Current employees at any time may apply for

coverage through Medical Evidence of Insurability

(acceptance not guaranteed).

Deferred enrollment opportunities may be available

after accumulating specific amounts of sick leave.

Disability/income replacement

insurance that replaces up to 75% of

salary if unable to work due to short or

long term disability. Starting February

1, 2024, if enrolled in Income

Continuation coverage is up to

$120,000.

Benefits begin after 30 consecutive

calendar days or use of all

accumulated sick leave (up to 130

days), whichever is greater.

State and federal entitlements or

payments from other employer-

sponsored programs may reduce

benefits.

ICI: Premiums are based on an

employee’s biweekly salary and

accumulated sick leave. As an

employee accumulates sick leave, the

percentage of premium contributed by

the State increases.

Basic ICI: 0% - 100% of

premium depending upon

sick leave balance and

accumulation.

Supplemental ICI Plan:

0%

Return to Table of Contents Page 8 of 10

LIFE INSURANCE

– Securian

Who is Eligible and When

Benefits You Receive

Employee Pays

State Pays

Must apply in the first 30 days of employment if

a new hire. Coverage is effective the first of month

after 30 days of employment.

Current employees at any time may apply for

coverage through Medical Evidence of Insurability

(acceptance not guaranteed).

Employees experiencing qualifying events will have

the opportunity to make changes or elect coverage

for spouse and dependents within 30 days of

event.

Term group life insurance with

coverage option of up to five times

annual salary (Basic, Supplemental,

and three levels of Additional).

Coverage reduces after age 70 for

active employees.

After termination with 20 years of

WRS service or at retirement,

coverage can be continued. Premium

ends at age 65 and your coverage

reduces to 75% of your basic

coverage, if retired, and at age 66

coverage drops to one-half of the

original Basic coverage; any coverage

in addition to Basic coverage ceases

at age 65 (if retired).

Spouse and Dependent coverage

available. Accidental Death and

Dismemberment and Living Benefits

are included.

Basic & Supplemental: Premium cost

based on age of employee and

amount of coverage.

Additional levels of employee

coverage and Spouse & Dependent

Coverage: 100%

Premiums for coverage up to $50,000

are deducted pre-tax.

Basic: Additional 65.25%

of employee’s premium

amount.

Supplemental: Additional

37.25% of employee’s

premium amount.

Additional levels of

employee coverage and

Spouse & Dependent

Coverage: 0%

Return to Table of Contents Page 9 of 10

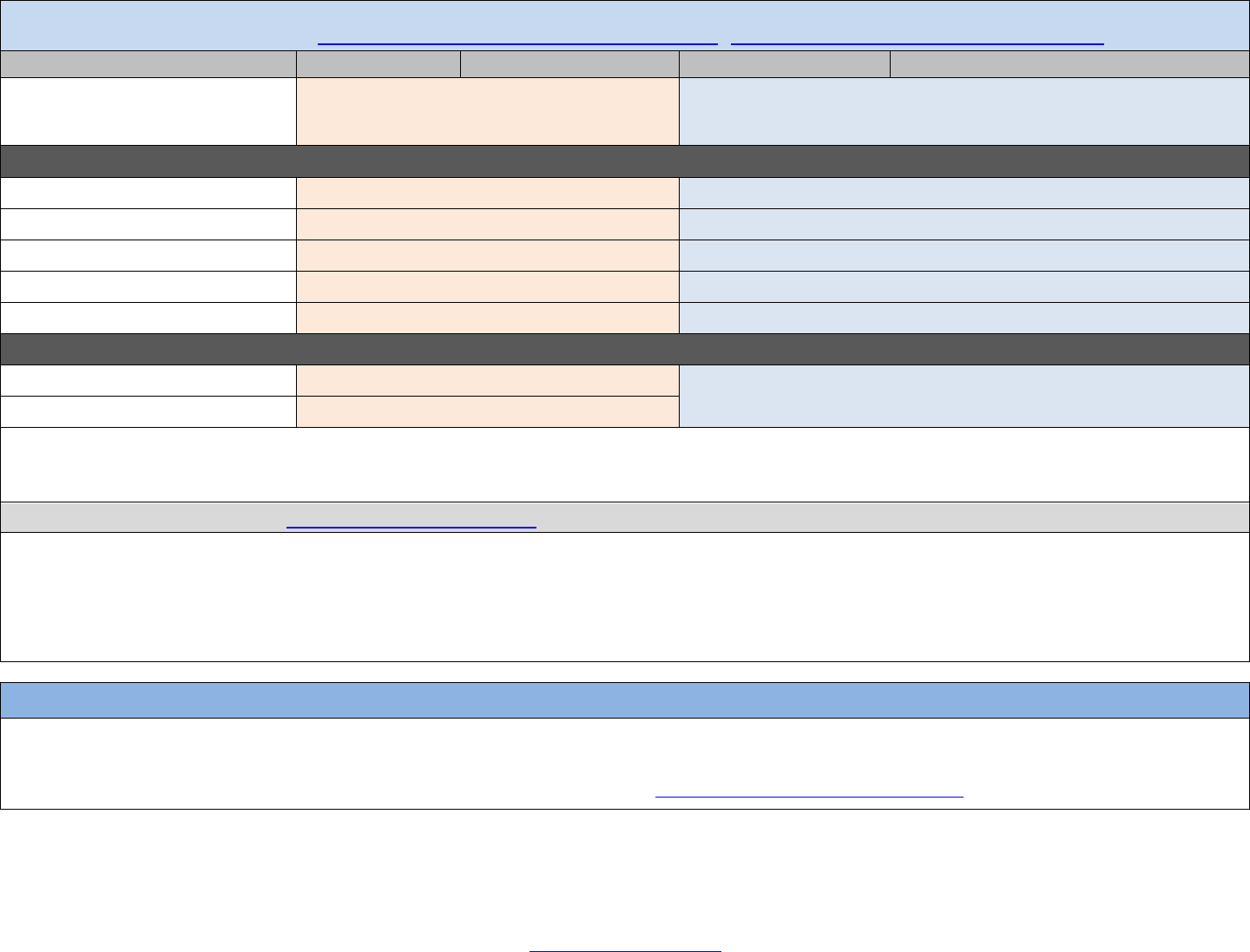

WISCONSIN RETIREMENT SYSTEM (WRS)

– RETIREMENT PENSION PLAN

Who is Eligible and When Benefits You Receive Employee and State Contributions

WRS coverage is immediate and

mandatory for those eligible. You must

meet the following requirements in order to

be eligible for coverage under the WRS:

• If you first became a WRS

participating employee on or after

July 1, 2011, you must be expected to

work at least 2/3 of full-time for at least

one year*.

• If you first became a WRS

participating employee prior to July 1,

2011, you must be expected to work at

least 1/3 of full-time for at least one

year*.

Not eligible at time of hire

If you do not initially meet the WRS

eligibility requirements, you can become

eligible if the expectation of hours worked

and/or the duration of employment changes,

and you meet the WRS eligibility criteria. At

that time, you will be enrolled in the WRS.

Your employment will also be evaluated for

WRS eligibility at your one-year

anniversary. If you did work the minimum

amount of hours to be eligible, you will be

enrolled in the WRS.

Returning to WRS-covered employment

within 12 months

If you are a WRS-covered employee and

you terminate and are subsequently rehired

in less than 12 months at the same

employer, unless you have taken a WRS

benefit you will be re-enrolled in the WRS

immediately upon rehire, regardless of

whether or not the new employment period

is expected to meet the WRS eligibility

criteria.

Must have five years of creditable WRS service to be

vested in the WRS (may take more than five years if

working part-time).

General/Executive class minimum retirement age is

55 years. Protective class minimum retirement age is

50 years.

WRS also provides death and separation benefits.

Percent of gross wages depending on the WRS category.

See chart below.

Deductions taken on a pre-tax basis for state and federal

tax purposes.

Employees are eligible to contribute additional amounts to

their account (post-tax).

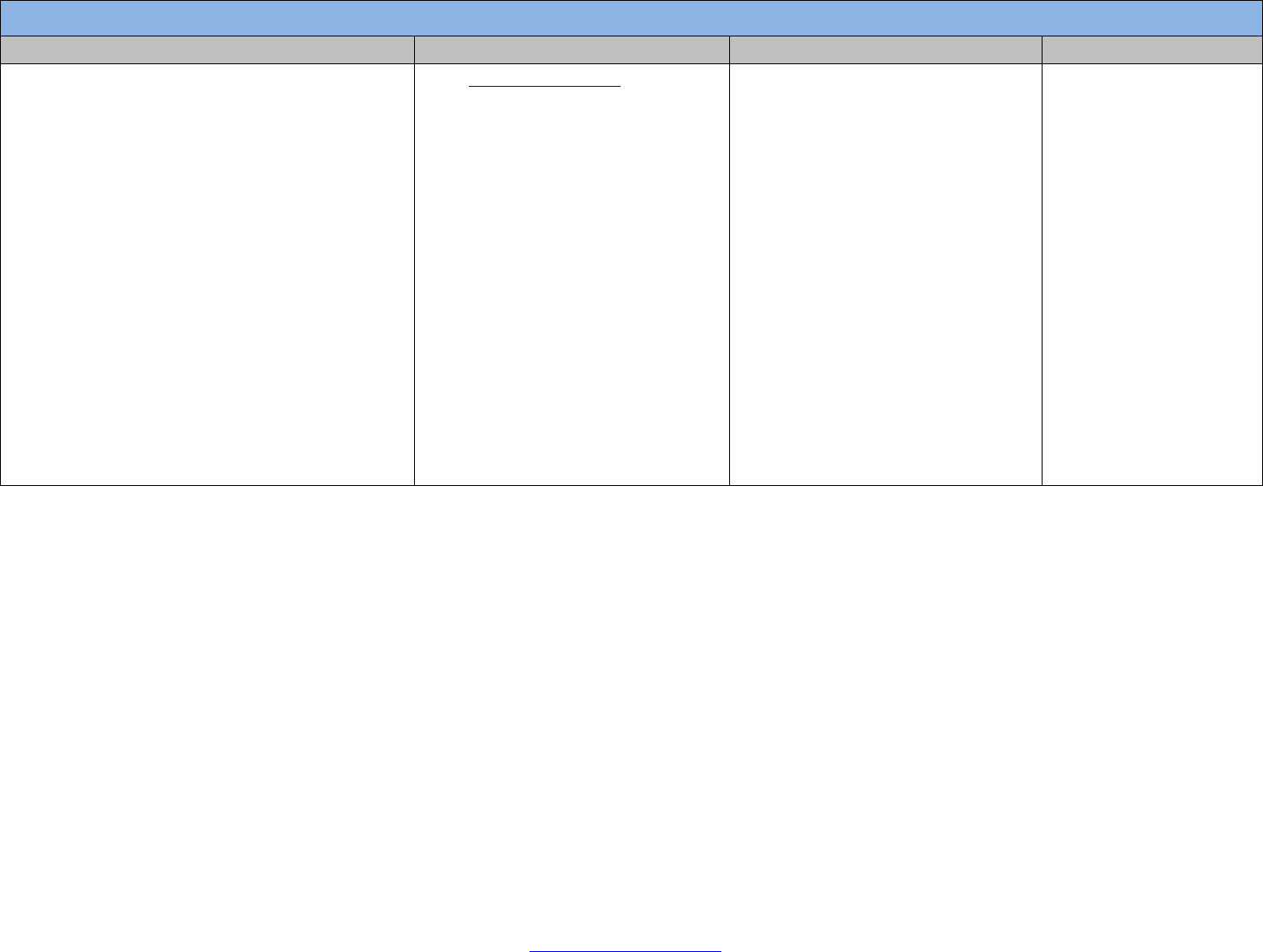

Employee Category

Employee

Contribution

2024

Employer

Contribution

2024

General/Teacher 6.90% 6.90%

Elected

Official/Executive/Judge

6.90% 6.90%

Protective 6.90% 14.30%

Return to Table of Contents Page 10 of 10

WISCONSIN DEFERRED COMPENSATION (WDC)

Who is Eligible and When Benefits You Receive Employee Pays State Pays

All employees are eligible and can enroll at

any time.

For more information see the WDC web site

at www.wdc457.org

• Under age 50 contribution limit:

$22,500 in 2023

• Age 50 & Over contribution limit:

$30,000 in 2023

This voluntary

supplemental retirement savings

program (457) allows employees to invest a portion of

their income either pre-tax or post-tax (Roth).

Funds are chosen and monitored by the State of

Wisconsin Deferred Compensation Board.

Total contribution on pre-tax and/or post-

tax (Roth option) basis.

Administrative fee based on account

balance.

0%

EDVEST

(529 College Savings Account)

Who is Eligible and When Benefits You Receive Employee Pays State Pays

All employees are eligible and can enroll at

any time.

Edvest is a simple way for families to save

for higher education costs. Choose from a

variety of investment options and contribute

to your account regularly. State of

Wisconsin employees can contribute by

payroll direct deposit for a minimum

contribution of $15 per pay period.

Edvest is a voluntary college saving account which

allows employees a flexible and tax advantaged

way to save for higher education and career

training.

Wisconsin residents who contribute to an Edvest

account may be eligible for a state tax deduction.

Total contribution 0%