TAXABILITY OF EMPLOYEE BENEFITS

WHAT ARE EMPLOYEE BENEFITS?

An employee benefit is any benefit provided or paid by the

employer for the benefit of the employee or the employee’s

family. Benefits are generally included in the employee’s

wage for tax purposes, except those benefits that qualify for

exclusion. A table describing the taxability of common

employee benefits begins on page two of this information

sheet.

WHO IS AN EMPLOYEE?

For Unemployment Insurance

(UI), Employment Training Tax

(ETT), and State Disability Insurance* (SDI) purposes,

“employee” includes

an officer of a corporation, an employee

under the usual common law rules, and any worker whose

services are specifically covered by law. For more

information, refer to Information Sheet: Employment, DE 231.

For Personal Income Tax (PIT) purposes, “employee”

in

cludes a resident of California who receives remuneration

for services performed within or without this state, a

nonresident who receives remuneration for services

performed within this state, or an officer of a corporation.

However, the term “employee” has different meanings in

relation to the types of benefits shown in the Fringe Benefits

section of the attached table. For example:

• For working condition fringes, the term “employee”

inc

ludes a current employee, a partner who performs

services for the partnership, a director of the employer,

and any independent contractor who performs services

for the employer.

• For qualified transportation reimbursements and

qual

ified moving expense reimbursements, the term

“employee” includes a current employee and a leased

employee who has provided services on a substantially

full-time basis for at least a year under the employer’s

primary direction and control. For these benefits,

however, “employee” does not include a 2 percent

shareholder/employee of an S corporation.

PLEASE NOTE: For determining the taxability of employee

be

nefits, the definition of who qualifies as an employee is

the same for California purposes as it is for federal purposes,

with one important exception: California law provides that a

registered domestic partner (as defined in Section 297 of the

Family Code) is the same as a spouse, except when in

conflict with federal law.

WHAT ARE WAGES?

Wages are payments made to an employee for his or her

personal services, including commissions, bonuses, and the

reasonable cash value of all amounts paid to employees in

any medium other than cash (for example, taxable benefits).

WHAT ARE BENEFITS THAT QUALIFY FOR EXCLUSION

FROM INCOME?

“Wages” does not include any benefit that is qualified for

exclusion from income. To be qualified, the benefit must

be either specifically excluded from wages (income) in

the California Unemployment Insurance Code (CUIC) or

excluded in the CUIC by reference to the Revenue and

Taxation Code or the Internal Revenue Code.

Benefits may be excluded from wages in full, partially, or

on

ly to the extent that certain conditions are met. Please

note the attached table does not explain the conditions for

the excluded benefits. The table only addresses the

taxability of the benefits when all the required conditions

have been met.

ADDITIONAL INFORMATION

For further assistance, please contact the Taxpayer

As

sistance Center at 888-745-3886 or visit the nearest

Employment Tax Office listed in the California Employer’s

Guide, DE 44 and on the EDD website at

http://www.edd.ca.gov/Office_Locator/.

The EDD is an equal opportunity employer/program.

Auxi

liary aids and services are available upon request to

individual with disabilities. Requests for services, aids,

and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

*Includes Paid Family Leave (PFL)

DE 231EB Rev. 12 (6-17) (INTERNET) Page 1 of 4

CU

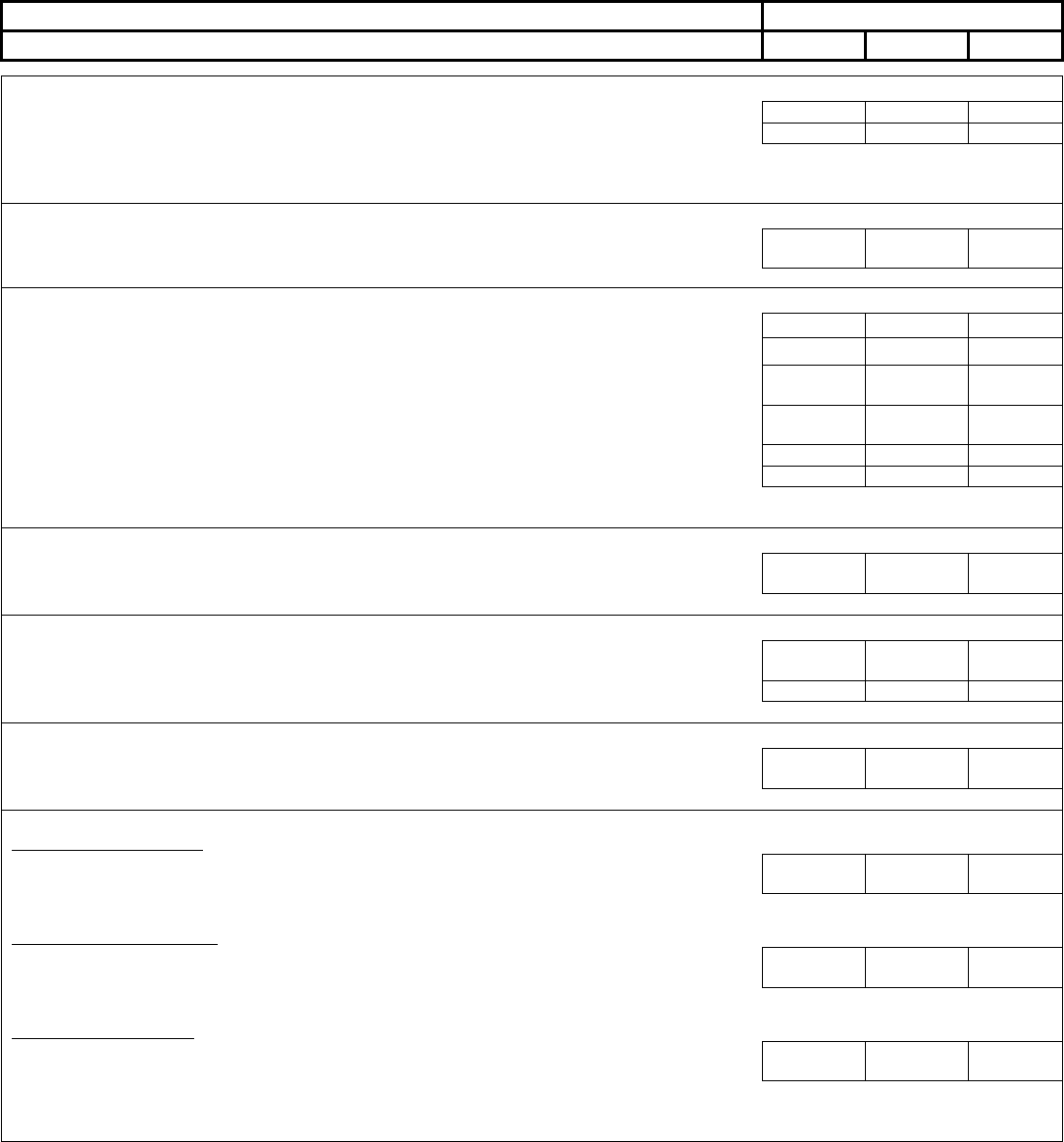

TYPE OF BENEFIT

CALIFORNIA

UI/ETT

SDI

PIT

ACHIEVEMENT AWARDS

Not Subject

Not Subject

Not Subject

• Qualified plan awards not to exceed $1,600.

Not Subject Not Subject Not Subject

Awards given in the form of tangible personal property (other than cash or securities). The maximum award amounts have been in effect since

January 1, 1987.

• Nonqualified awards of $400 or less.

ADOPTION ASSISTANCE

•

A program under Section 137 of the Internal Revenue Code provides for the gross income exclusion of

qualified adoption expenses.

Subject Subject Not Subject

CAFETERIA PLANS

• Employer contributions for benefits excludable from gross income.

Not Subject Not Subject Not Subject

•

Employer contributions into a cafeteria plan for a health savings account.

Subject Subject Subject

•

Employee salary reductions to a qualified Section 401(k) of the Internal Revenue Code retirement

program.

Not Subject Not Subject Not Subject

•

Employee salary reduction for dependent care assistance, accident, health, and/or group-term life

insurance.

Not Subject Not Subject Not Subject

Subject

Subject

Subject

• Cash payments in lieu of qualified benefits.

Subject Subject Not Subject

• Contributions into cafeteria plan for adoption assistance.

Adoption assistance program payments from a cafeteria plan are not subject for UI, ETT, SDI, and PIT withholding purposes.

DEPENDENT CARE ASSISTANCE

•

Employer payments not to exceed $5,000 or $2,500 if married filing separately. The maximum assistance

has been in effect since January 1, 1987.

Not Subject Not Subject Not Subject

DISASTER RELIEF PAYMENTS

•

Employer payments that qualify as disaster relief payments as defined in Section 139 of the Internal

Revenue Code.

Subject Subject Not Subject

Not Subject

Not Subject

Not Subject

• Amounts paid by an employer by reason of the death of an employee who is a specified terrorist victim.

EDUCATIONAL ASSISTANCE

•

Educational assistance payments under Section 127 of the Internal Revenue Code excluded from gross

income for undergraduate and graduate level courses not to exceed $5,250 per calendar year.

Not Subject Not Subject Not Subject

FRINGE BENEFITS (Also

refer to Internal Revenue Service Publication 15-B.)

No-Additional

-Cost Services:

•

Service* provided to an employee when the employer incurs no substantial additional cost in providing

the service and the service is offered to customers in the ordinary course of the employer's business.

Not Subject Not Subject Not Subject

*Excess capacity airline, bus, train, and

subway tickets; hotel rooms, etc.

Qualified Employee Discounts:

•

Discounts* offered to employees for the same services or merchandise offered to customers in the

ordinary course of the employer's business.

Not Subject Not Subject Not Subject

*The maximum discount is 20 percent on services or the gross profit percentage on merchandise.

Working Condition Fringes:

•

Any property or service that would be allowable to the employee as a business expense or as a

depreciation deduction.

Not Subject Not Subject Not Subject

Business use of an employer-prov

ided vehicle or use of a qualified demonstration automobile. Educational assistance and training provided to the

employees that are not excludable from gross income under Section 127 of the Internal Revenue Code.

DE 231EB Rev. 12 (6-17) (INTERNET) Page 2 of 4

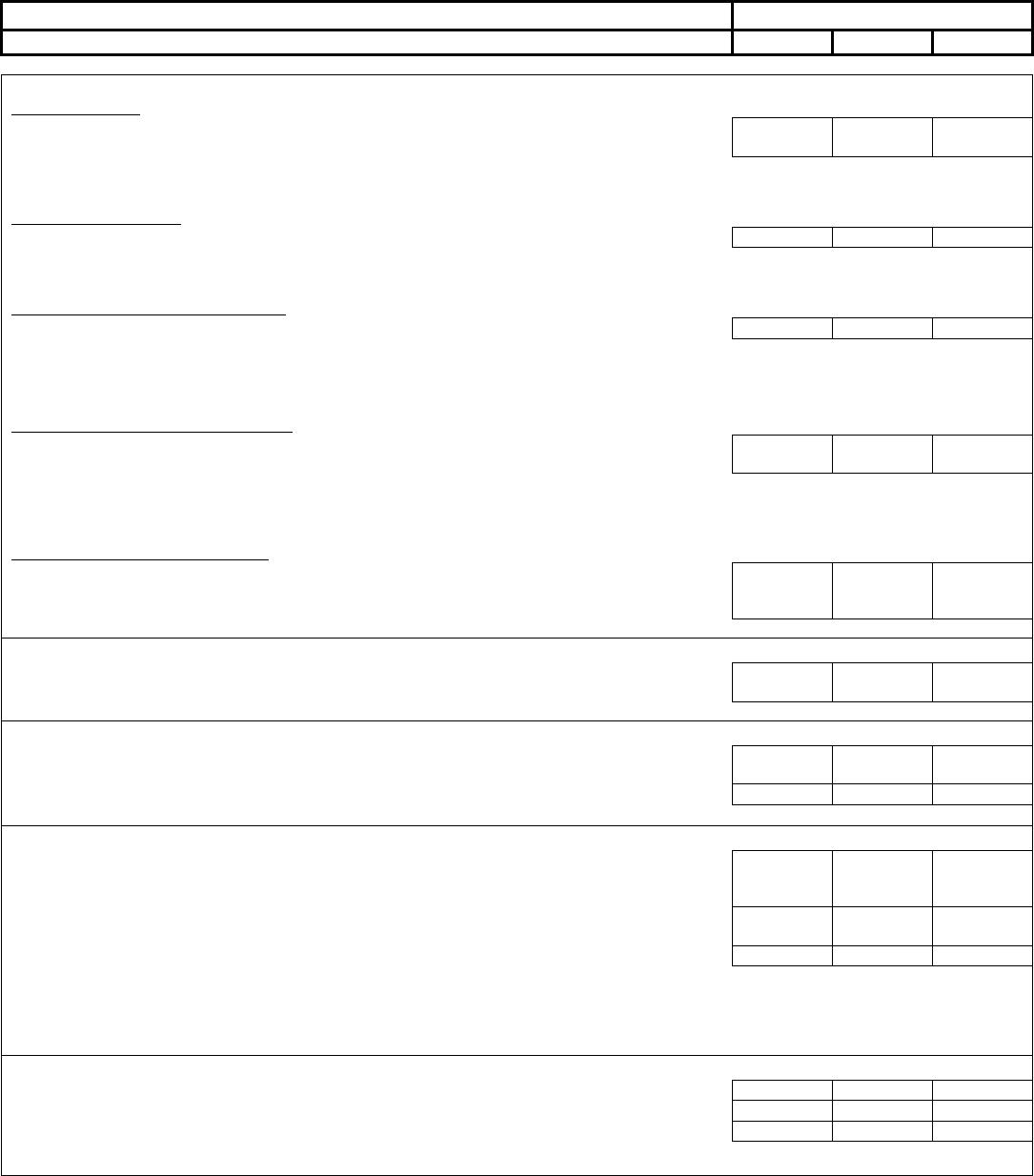

***

Not Subject

Not Subject

TYPE OF BENEFIT

CALIFORNIA

UI/ETT

SDI

PIT

FRINGE BENEFITS (Continued)

De Minimis Fringes:

• The value of property or service which is so small as to make accounting for it unreasonable or

administratively impracticable.

Not Subject Not Subject Not Subject

Meals: Coffee, doughnuts, or soft drinks.

Other: Holiday gifts; tickets for entertainment or sporting events; life insurance on spouse or dependent face amount less than $2,000.

Qualified Athletic Facility:

• Any gym or other athletic facility provided by an employer to its employees.

Not Subject

Not Subject Not Subject

The employer must own or lease the facilities; operate or contract out the operation; and substantially all use of the facility during the calendar year is by

employees of the employer, their spouses, and their dependent children.

Qualified Transportation Reimbursements:

• Employee commuting benefits.

Not Subject Not Subject Not Subject*

Transit passes, tokens, cash reimbursements for mass transit use, vanpooling, and/or employer-provided parking, up to a fair market value not exceeding

the limits established in Section 132(f) of the Internal Revenue Code.

*For PIT purposes only, there are no monetary limits.

Qualified Moving Expense Reimbursement:

• Any amount which would be deductible as a moving expense under Section 217 of the Internal

Revenue Code.

Not Subject

Not Subject Not Subject*

*For PIT purposes only, California conforms to federal law under Section 217 of the Internal Revenue Code.

For UI, ETT, and SDI, there is an exemption if at the time of payment, it is reasonable to believe that the employee is entitled to a deduction under

Section 217 of the Internal Revenue Code (Section 937 of the CUIC).

Qualified Retirement Planning Services:

• Fringe benefit excluded from gross income under Section 132 of the Internal Revenue Code for

retirement planning advice or information provided to an employee and his or her spouse by an

employer maintaining a qualified employer plan.

Not Subject Not Subject Not Subject

GROUP LEGAL SERVICES

•

Any contribution, payment, or service provided by an employer for qualified group legal services

pursuant to Sections 926 and 13009 of the CUIC.

Subject Subject Subject

HEALTH SAVINGS ACCOUNT (HSA)

• Employer contributions to a qualified plan on behalf of an employee, the employee’s spouse, and/or the

employee’s dependent(s).

Subject Subject Subject

•

Employee salary reductions to a qualified plan.

Subject Subject Subject

HEALTH, SICKNESS, ACCIDENT, DENTAL, AND OPTICAL PLANS

•

Employer contributions to a qualified plan on behalf of an employee, as well as the employee’s spouse

and/or dependent(s) that has not reached 27 years of age by the end of the taxable year.

(See Section 938.4 of the CUIC.)

Not Subject

• Employer-provided accident or health coverage or medical reimbursements paid for an employee’s

domestic partner.

*

Subject Subject Not Subject

• Employee salary reductions to a qualified plan.**

Subject Subject Subject

*Effective January 1, 2002, the Personal Income Tax (PIT) law was amended to extend the tax benefits of employer-provided coverage under accident and

health plans to domestic partners (as defined in Section 297 of the Family Code). Such payments are excluded from PIT wages as well as PIT withholding.

**Contributions are exempt when included in a qualified Cafeteria Plan.

***For PIT purposes, subject for 2 percent shareholder/employee of S corporations.

LIFE INSURANCE

• Group term insurance with a face amount of $50,000 or less.

Not Subject Not Subject Not Subject

• Group term insurance with a face amount in excess of $50,000.

Not Subject Not Subject Not Subject*

• All other life insurance premiums.

Not Subject Not Subject Subject

*Although PIT withholding is not required, it is reportable as PIT wages.

DE 231EB Rev. 12 (6-17) (INTERNET) Page 3 of 4

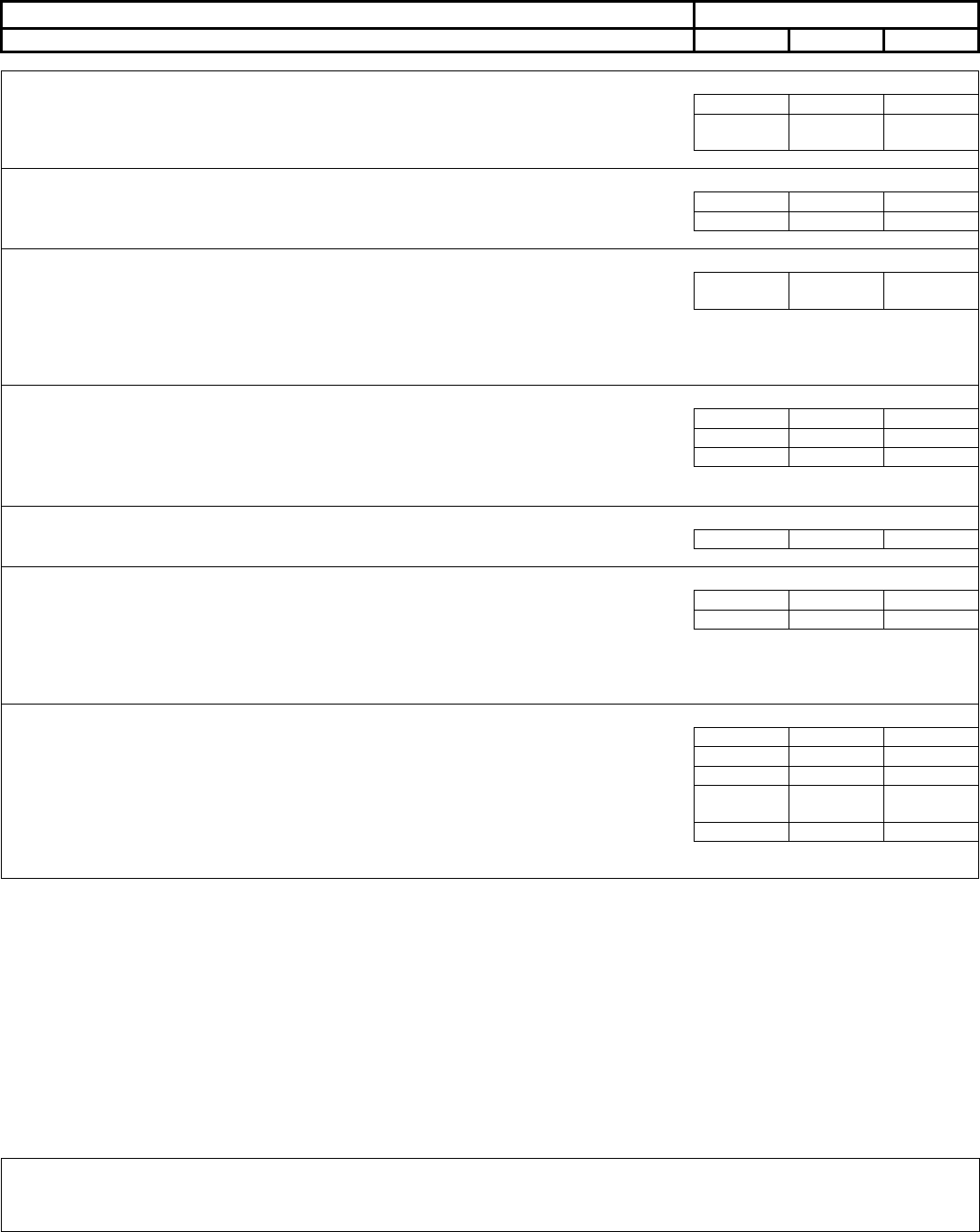

TYPE OF BENEFIT

CALIFORNIA

UI/ETT

SDI

PIT

MEALS AND LODGING

Subject

Subject

Not Subject

• Meals furnished for the employer's convenience and on the employer's premises.

•

Lodging furnished for the employer's convenience, on the employer's premises, and as a condition of

employment.

Subject Subject Not Subject

MEDICAL SAVINGS ACCOUNT

Subject

Subject

Subject

• Employee contributions.

Subject

Subject

Not Subject

• Employer contributions.

MOVING EXPENSES

•

Employer paid or reimbursed expenses for moving household goods, personal effects, and traveling

expense.

Not Subject Not Subject Not Subject*

*For PIT purposes only, California conforms to federal law under Section 217 of the Internal Revenue Code.

F

or UI, ETT, and SDI, there is an exemption if, at the time of payment, it is reasonable to believe that the employee is entitled to a deduction under

Section 217 of the Internal Revenue Code (Section 937 of the CUIC).

RETIREMENT PLANS - DEFERRED COMPENSATION

Subject

Subject

Not Subject

• Employer contributions to a qualified plan (unless under cafeteria plan, see page 2).

Subject

Subject

Not Subject

• Employee salary reduction contributions to a qualified plan (unless under cafeteria plan, see page 2).

Subject

Subject

Subject

*

*When the funds become “constructively available” unless the employee elects not to have the tax withheld pursuant to Section 13028 of the CUIC.

• Contributions to a nonqualified plan.

SCHOLARSHIPS AND FELLOWSHIPS

Not Subject

Not Subject

Not Subject

• Qualified tuition and related expenses as provided under Section 117 of the Internal Revenue Code.

TUITION PROGRAMS

*

Subject

Subject

Subject

• Employer contributions to a qualified plan.

Not Subject Not Subject Not Subject

• Employee/participant contributions to a qualified plan.

*For example, the Golden State Scholarshare Trust. Prior to 2002, only a state could establish and maintain a Qualified Tuition Program. Beginning in

2002, educational institutions also may establish and maintain a qualified tuition program. Employer contributions are subject to taxes, and employee

contributions are made from earnings that have already been taxed.

VACATION AND SICK PAY

Subject Subject Subject

• Employer paid vacation.

Not Subject

Not Subject

Subject

• Vacation and sick pay earned but not paid until after termination of employment.

Subject

Subject

Subject

• Sick leave payments for the first full six calendar months.

•

Sick payments made a full six calendar months following the last month in which the employee

performed services.

Not Subject Not Subject Subject

Subject

*

Not Subject

Not Subject

• Third-party payments of sick pay.

*Exempt if payments are made more than six months after the last calendar month in which the employee worked.

This information sheet is provided as a public service and is intended to provide nontechnical assistance. Every attempt has been made to provide

information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that is inconsistent with the

law, regulations, and administrative and court decisions is not binding on either the Employment Development Department or the taxpayer. Any

information provided is not intended to be legal, accounting, tax, investment, or other professional advice.

DE 231EB Rev. 12 (6-17) (INTERNET) Page 4 of 4